Because the world’s most populous nation with the second greatest economic system by actual GDP, in addition to a big and quickly rising center class, it’s no surprise that the eCommerce market in China represents large untapped potential for western companies. That is particularly evident within the digital sector, the place the supply of on-line cost strategies in China has helped the eCommerce market there grow to be the world’s largest by a long way.

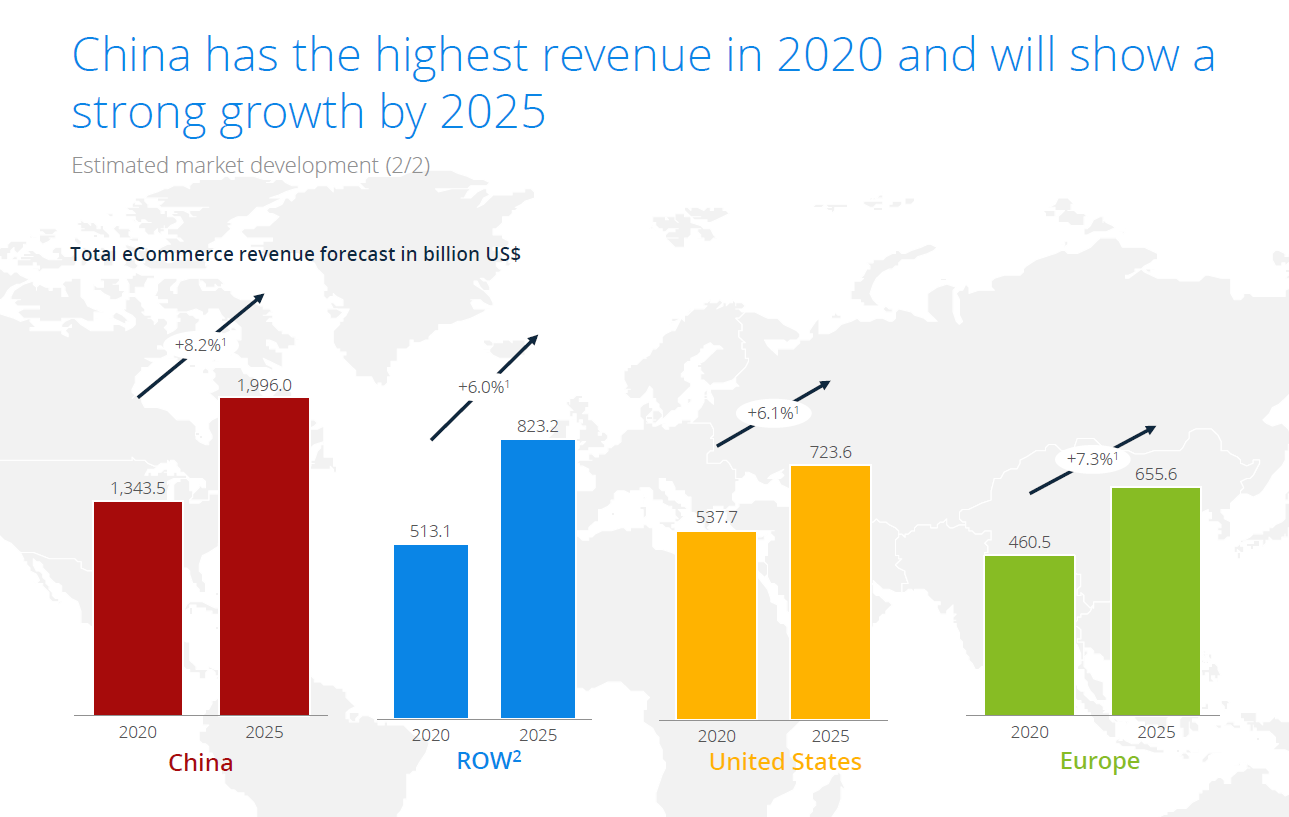

At the moment valued at over $1.5 billion and projected to achieve just below $2 billion by 2025, the Chinese language eCommerce market will quickly equal practically one-and-a-half instances that of america and Europe mixed.

Supply: Statista

The attraction for on-line companies is obvious, however China’s distinctive mixture of political insurance policies, insular tradition, and supply logistics make it difficult for unestablished companies to achieve a foothold.

On this article, we glance nearer on the Chinese language eCommerce market and the way to promote on-line there, together with Chinese language most popular cost strategies and client habits.

The Present eCommerce Market in China

China is the world’s main provider of every thing, from electronics and clothes to knowledge processing applied sciences and medical gear, which suggests the largest competitors for western companies in China is China itself. There’s additionally the political, social, and financial construction that may favor home sellers, particularly with established mega-retailers accounting for 10% of all on-line retail gross sales.

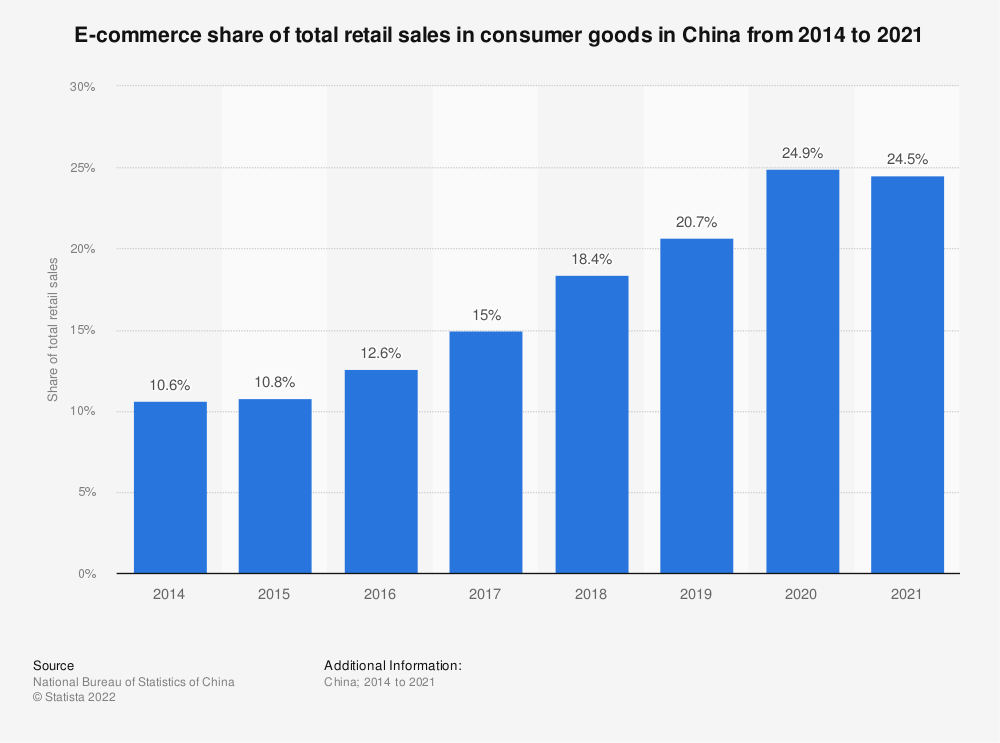

However whereas this makes it troublesome for brand spanking new or unfamiliar on-line corporations to ascertain themselves in China, the rewards for perseverance may be unbelievable. Think about that China has the world’s largest ‘middle-class consumption market phase’ that boasts over $41 trillion in buying energy. Retail eCommerce in China additionally makes up practically 25% of all retail gross sales, with skilled analysts anticipating that share to rise to 33% by 2025.

Supply: Statista

Maybe most relevantly to western companies searching for to interrupt into the eCommerce market in China, there’s a considerably giant and fascinating base of younger and prosperous ‘haitao’ buyers, which suggests those who purchase throughout borders.

The proportion of the Chinese language inhabitants that has web entry can be rising. Between 2019 and 2021, China’s rural web penetration elevated from just below 40% to almost 56%, which introduced the general fee as much as 73%. Simply counting between 2021 and 2022 alone, the variety of Chinese language web customers grew by practically 36 million.

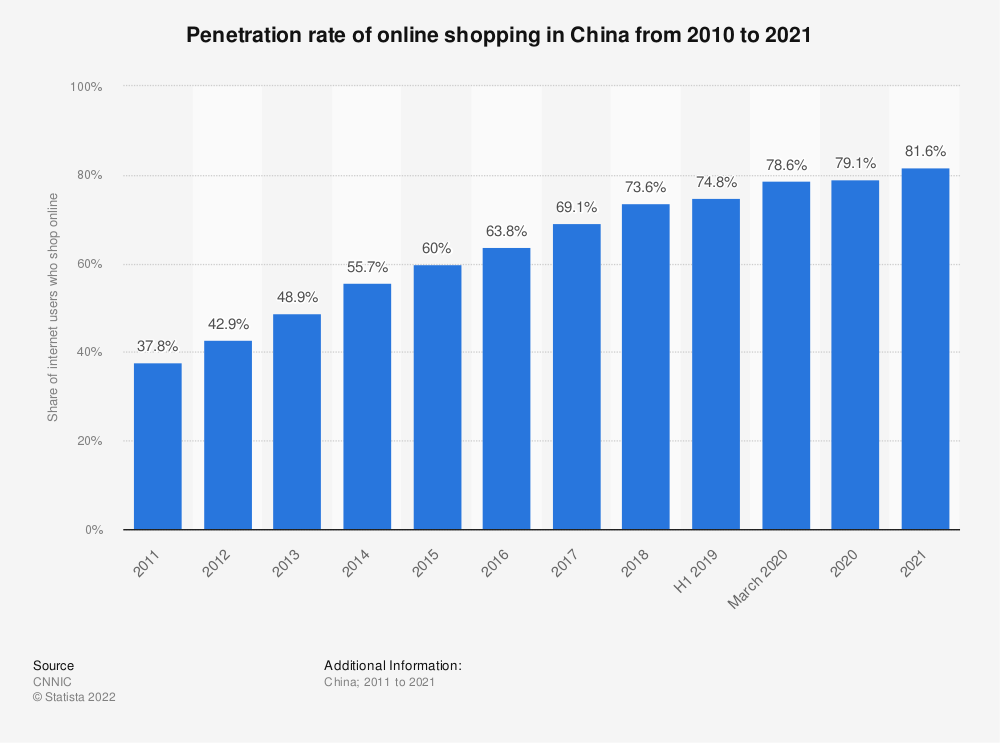

Simply 12 years in the past, solely 40% of China’s inhabitants was procuring on-line. Now, that quantity is nearer to 72% and is forecasted to achieve practically 84% by 2025. And bear in mind, these percentages are for a common inhabitants of over 1.4 billion individuals.

Supply: Statista

Alternative is clearly knocking for on-line companies – no less than for many who know the way to entry the eCommerce market in China.

Accessing the eCommerce Market in China

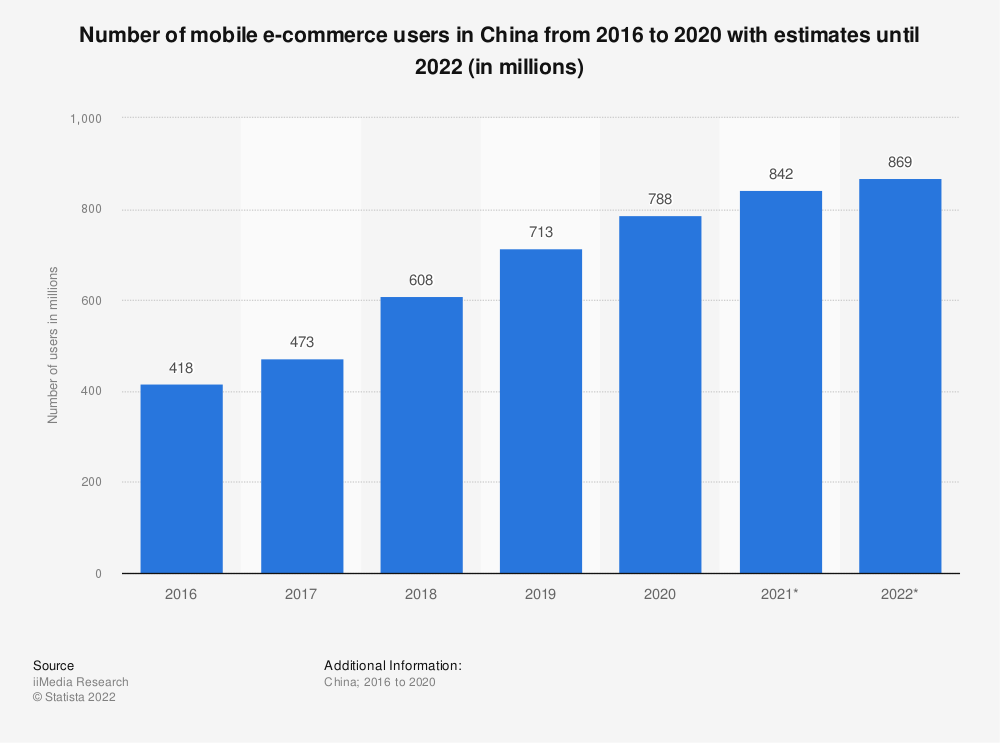

One of many greatest drivers of the rise in on-line procuring exercise in China has been the smartphone. China has positioned important emphasis on increasing cell broadband entry, which has helped make it a mobile-first nation, with 83% of the inhabitants subscribed to a cell service and 72% proudly owning a smartphone.

A large 99.7% of smartphone house owners within the nation use their cell gadgets to go surfing, leading to cell phone utilization representing 64% of all Chinese language internet visitors. The recognition of cell gadgets for web utilization has resulted in practically 70% of all Chinese language eCommerce being carried out through cell. In 2021, over 78% of all on-line gross sales of bodily items had been carried out through cell gadgets.

Supply: Statista

Clearly, any cross-border service provider searching for to entry the eCommerce market in China might want to accommodate this heavy leaning in direction of cell web utilization. To face any probability of accessing the Chinese language eCommerce market, a web-based retailer have to be optimized for cell, together with the overall consumer expertise in addition to cart movement and built-in Chinese language cost strategies.

Chinese language Procuring Tendencies and Booming Markets

Consciousness of procuring developments will even assist western companies discover success in China. For instance, native procuring holidays are nice on-line gross sales drivers, with Alibaba just lately producing $38 billion throughout a latest Single’s Day – an unofficial vacation celebrating people who find themselves not in a relationship. Different profitable holidays embody the Chinese language New Yr, 6.18 Day, and Golden Week, which all generate billions of on-line income annually.

Chinese language shoppers usually store throughout all classes, though there’s a clear inclination in direction of toys, hobbies, and DIY, which take a 26% share of the market. Vogue is shut behind at 25%, meals and private care make up 21%, whereas electronics and media make up 17%.

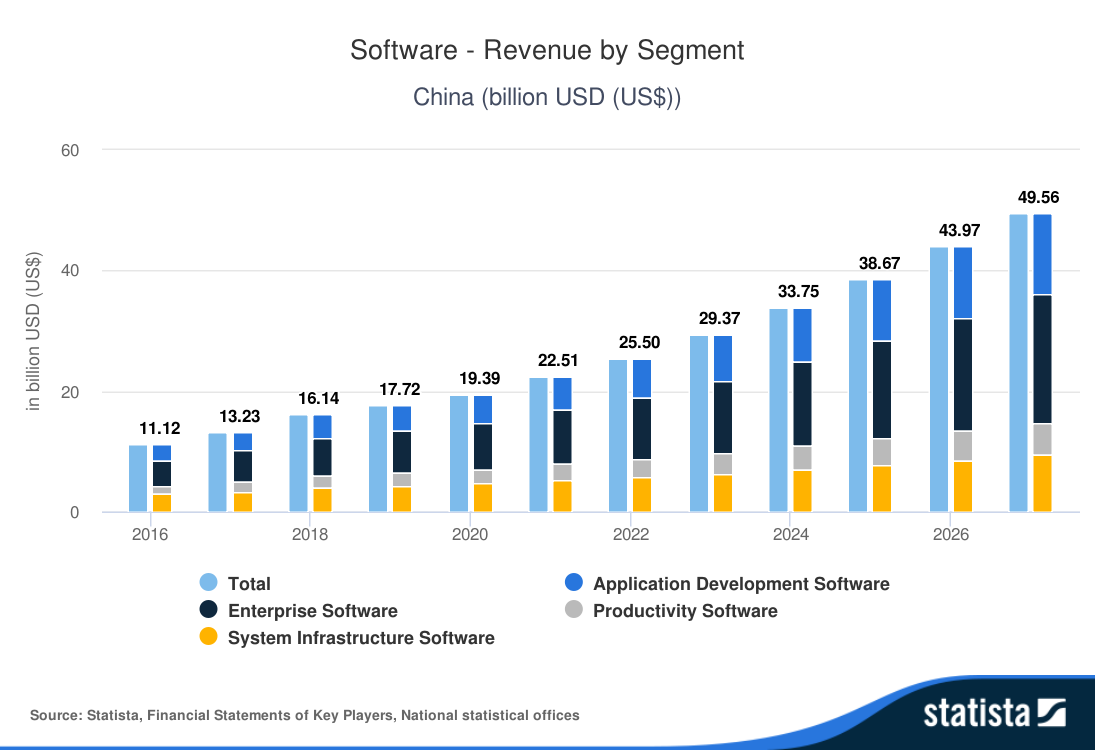

China additionally has the world’s fifth largest software program market, with the sector experiencing robust year-on-year development. The market is on monitor to exceed $25 billion already, with analysts anticipating sufficient development over the following few years for it to achieve over $49 billion by 2027.

Supply: Statista

The on-line subscription tradition in China is one other robust sector, with the Subscription Video on-Demand (SVOD) phase alone presently value over $14.5 billion and anticipated to exceed $24 billion by 2026.

Interesting to Haitao or Cross-Border Shopper

China has spent the final couple of many years making a wealthy web and eCommerce ecosystem that features native engines like google, commerce platforms, cost suppliers, and social media apps. The established mega-retailers are clearly benefiting from home gross sales facilitated by this ecosystem, however there’s a important alternative for non-Chinese language companies right here as nicely.

The haitao buyers, or affluent cross-border buyers, signify a small portion of the general quantity of on-line eCommerce in China at solely 3%. Nevertheless, that seemingly small share equates to $46 billion, which by itself would place it within the prime 10 of the world’s largest eCommerce markets.

In addition to optimizing for cell gadgets, the important thing to efficiently accessing the eCommerce market in China is interesting to those haitao buyers, so understanding their preferences is essential. Their affluence is an enormous clue, as their main preferences for cross-border procuring revolve round high quality, comfort, and standing.

Haitao buyers have cash to spend, however they’re discerning and want most comfort together with the highest high quality, in addition to the affirmation that solely the very best of the world’s prime manufacturers can present them. These sorts of buyers are often busy shoppers with both skilled and/or familial commitments, and they’re searching for out applied sciences, merchandise, and providers that may make their lives simpler. Fortuitously, they’re prepared to pay a premium for the comfort.

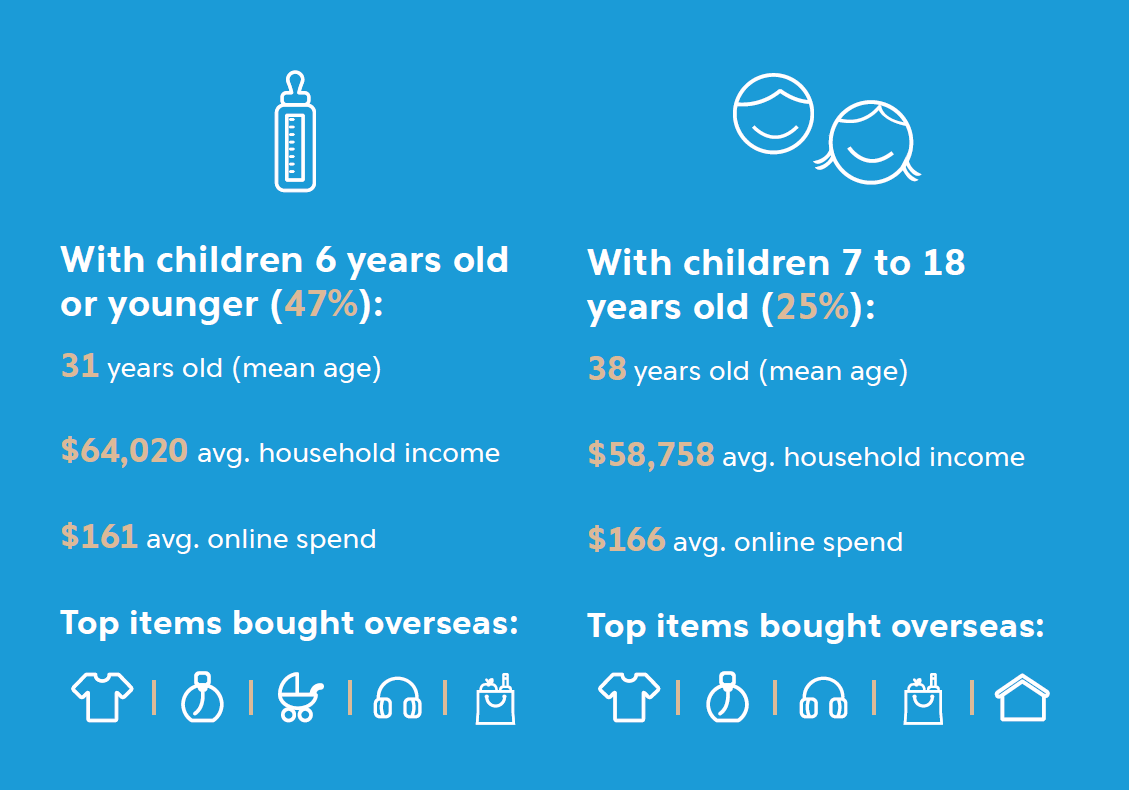

Married {couples} with kids make up the most important portion of haitao buyers at 72%, and they’re usually recognized for searching for high-end gadgets from classes together with style and electronics. Single individuals make up a major 17% of haitao buyers, and so they usually favor luxurious manufacturers and gadgets that may affirm their private standing.

Supply: PayPal

On-line Chinese language Fee Strategies

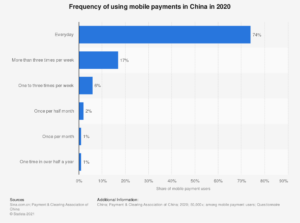

China is presently main the world in digital pockets adoption, with digital wallets changing into the preferred Chinese language cost strategies each on-line and offline. In simply the primary half of 2021, over 87% of Chinese language smartphone customers made a proximity cell cost, with the same quantity of web customers additionally utilizing a web-based cost service.

Supply: Statista

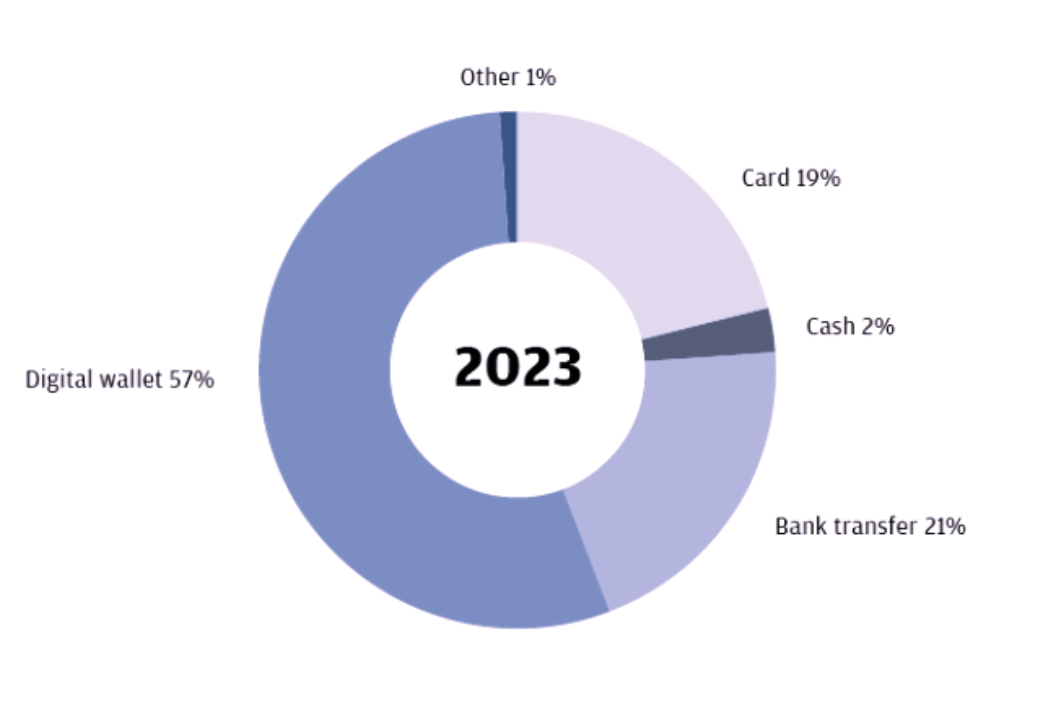

Whereas handy for city dwellers, digital wallets have additionally enabled rural buyers with out financial institution accounts to buy items on-line with out money. This has helped digital wallets achieve a 61% share of all Chinese language on-line cost strategies. Nevertheless, financial institution transfers stay fashionable, with a 21% share of on-line transactions, so cross-border retailers can be smart to supply their Chinese language prospects a wide variety of fashionable cost strategies.

Supply: JPMorgan

Promoting On-line in China

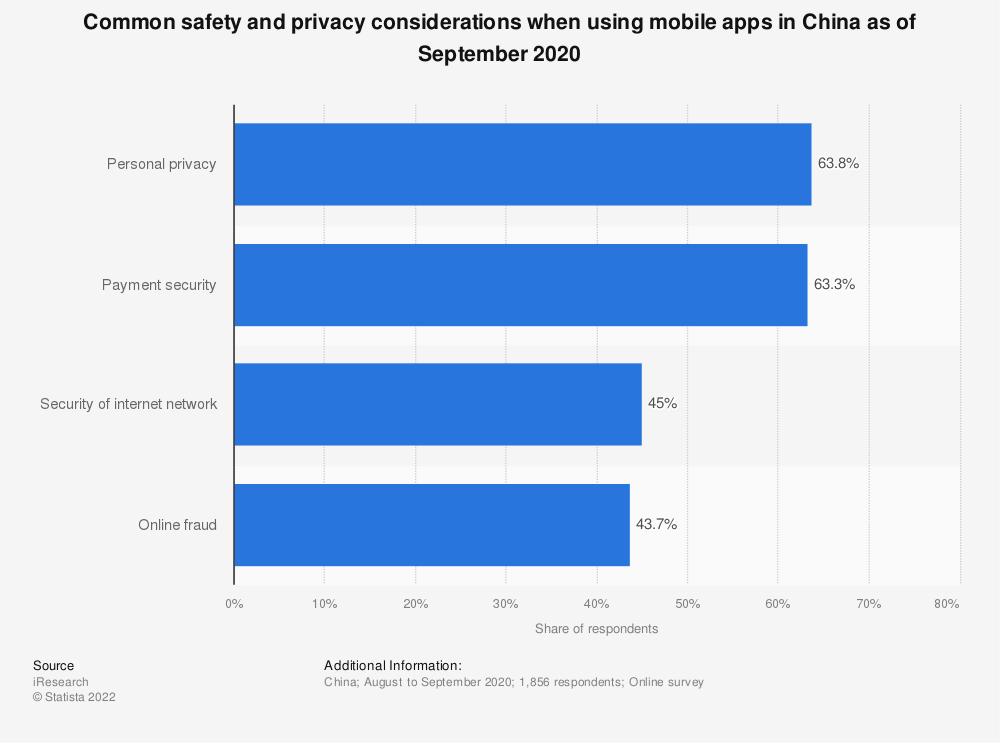

Such Chinese language cost strategies ought to embody native cost choices akin to UnionPay, AliPay, Tenpay, and WeChat Pay, alongside the extra acquainted Visa and Mastercard financial institution playing cards. Cross-border retailers should additionally study all in regards to the privateness protections and safety concerned with Chinese language cost strategies.

Supply: Statista

To study extra in regards to the eCommerce market in China, together with the most important boundaries to cross-border buying in line with Chinese language shoppers, learn our eBook “eCommerce in China” and uncover every thing you must promote on the eCommerce market in China.