Regardless of the hardships 2022 delivered, a short have a look at the place we’re at this time gives a much-needed supply of optimism for what could make our needs for a extra fruitful New Yr come true. On the draw back, huge tech’s current fall from grace was one for the historical past books, with the previous decade’s inventory market darlings ending the 12 months as notable laggards.

However there was constructive information as nicely, with 2022 bringing necessary breakthroughs in automation—the only focus of our analysis at ROBO International. In synthetic intelligence (AI), Dall-E and ChatGPT demonstrated the profound impacts of expertise utilizing generative AI that allows anybody to create illustrations and textual content at lightning velocity with just some easy directions to a pc program. On the robotics entrance, pandemic-driven provide chain disruptions created a serious push towards manufacturing unit and warehouse automation, thrusting corporations that ship collaborative robots and adaptive-control machining into the highlight. We imagine automation continues to be one of many world’s most constant and worthwhile themes.

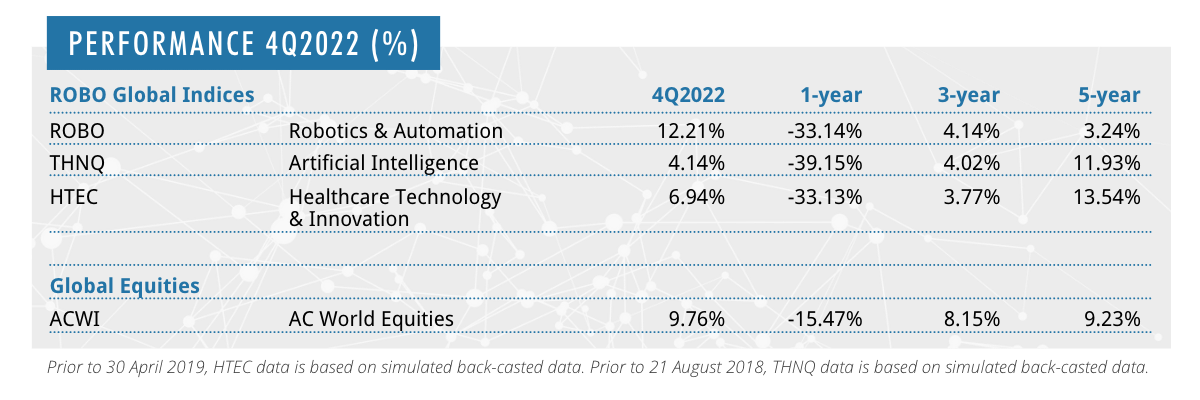

There’s doubtless extra development to be seen throughout the panorama of automation, together with robotics, AI, and healthcare expertise. Sure, shares are coming off their worst 12 months since 2008, however among the finest issues in regards to the New Yr is the chance for a contemporary slate. As evidenced by the positive aspects throughout our indices, 4Q22 introduced some stabilization and inexperienced shoots which may be setting the stage for development.

ROBO: Robotics & Automation Index

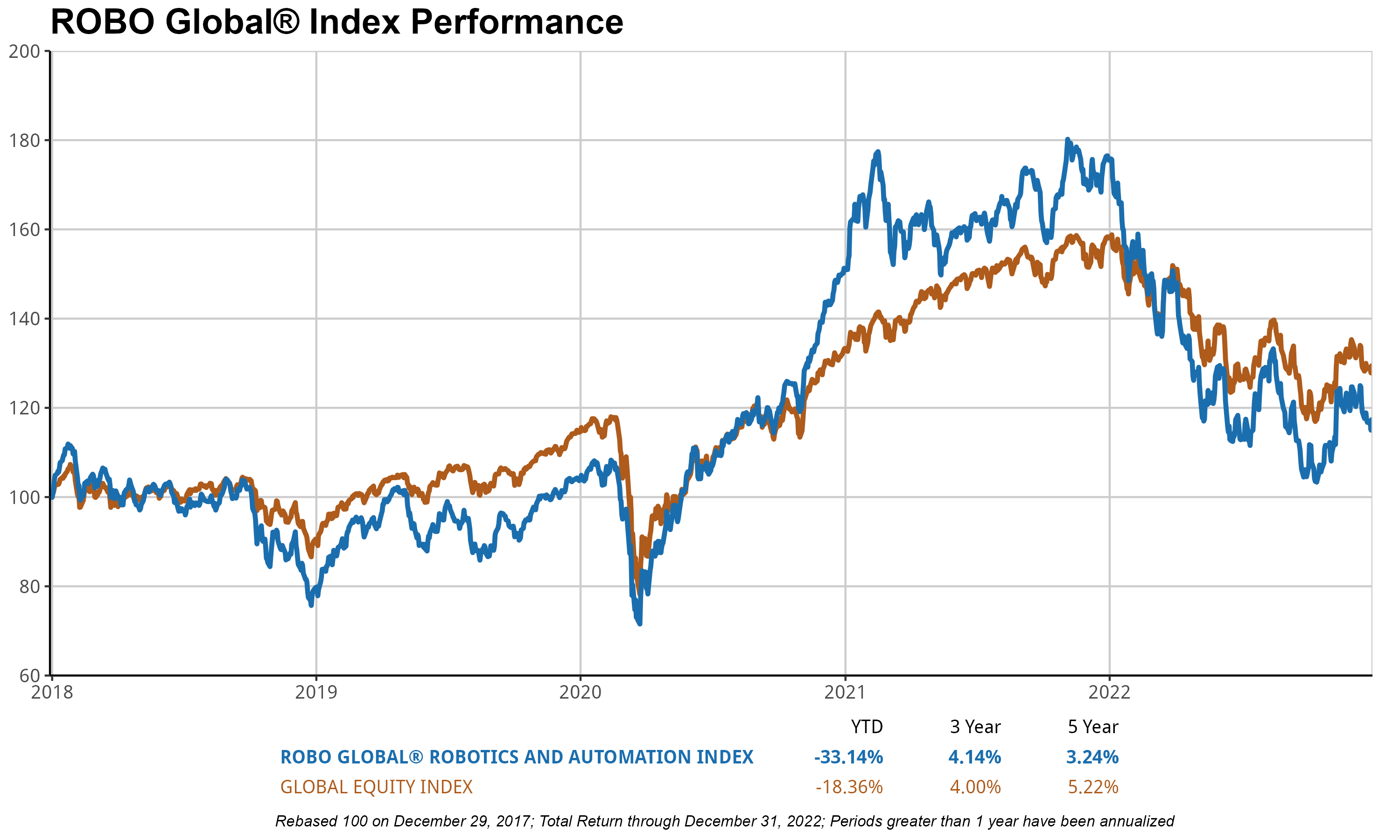

The ROBO International Robotics & Automation Index (ROBO) returned 12.1% in This fall, outperforming the 9.8% achieve for the MSCI AC World Index in the course of the quarter. After a file 42% drawdown from its November 2021 excessive via September 2022, the index of best-in-class robotics & automation equities around the globe rose within the double digits, led by robust positive aspects in Europe (+25%) and Logistics Automation (+20%), whereas US (+7%) and 3D printing (-14%) shares lagged.

Whereas the 33.1% annual decline in 2022 was unprecedented for the reason that inception of the ROBO index in 2013, it got here after a 120% cumulative achieve within the prior three years, and it was pushed by a 1/3 compression in valuation multiples: ROBO is buying and selling on a ahead PE ratio of 22x in comparison with 33x a 12 months in the past. Within the meantime, earnings have remained on a sturdy development trajectory, reflecting the continued energy of demand for automation expertise and options, and the power of corporations within the ROBO to deal with rising price and provide chain challenges. Earnings estimates for 2022 and 2023 have been minimize by 0-4% over the previous 3 months and by 9-10% over the previous 12 months. In the meantime, income estimates have remained almost unchanged and at the moment level to 11% YoY in each 2022 and 2023.

Logistics Automation, which accounts for 14% of the index by weight, noticed a 20% achieve in This fall after three consecutive quarters of losses however stays down 44% for the 12 months and again to pre-Covid ranges, regardless of the numerous improve in enterprise volumes. Equally, Sensing, Actuation, and 3D printing are all buying and selling under pre-Covid ranges, which is especially fascinating since that was low within the industrial cycle. The excellent news is that manufacturing PMIs around the globe at the moment are under 50, a stage that has traditionally supplied wonderful entry factors in Manufacturing unit Automation shares (1/3 of the ROBO portfolio). But opposite to prior industrial downcycles, order backlogs at market and expertise leaders stay terribly excessive and supply enterprise leaders with a lot better visibility than in prior smooth markets.

We additionally count on Japanese corporations, which account for 22% of the ROBO index and have a mixed 40% share of the world’s industrial robotic market, to learn from 1) the sturdy financial restoration in China after a chaotic path out of Covid restrictions, and a pair of) the dramatic depreciation within the Japanese Yen, which gives a considerable price benefit and may result in margin enlargement.

THNQ: Synthetic Intelligence Index

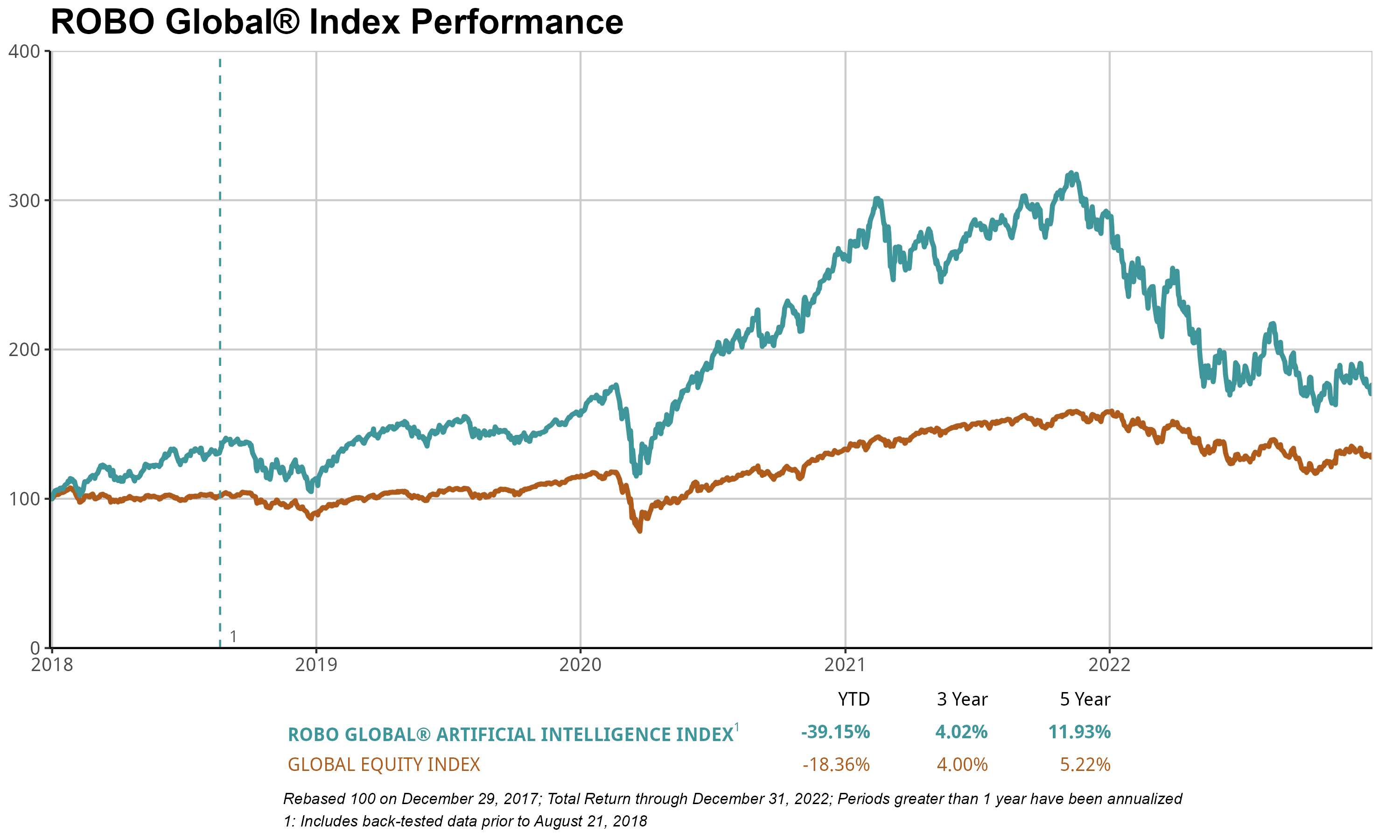

The ROBO International Synthetic Intelligence Index (THNQ) rose 4.4% in This fall, underperforming the MSCI AC World Index (+9.8%) and S&P 500 (+7.6%). Valuations contracted additional, right down to 4.5x Ahead EV/Gross sales vs 6.9x historic common. This fall noticed gross sales development of 18%, whereas EBITDA development accelerated to 32% vs the 17% historic common since 2013.

Within the final quarter of 2022, absolutely the standout growth in Synthetic Intelligence was the fulgurant adoption of generative AI fashions throughout language, picture, and video functions, taking the world by storm. Firms like Microsoft are already implanting Open AI’s expertise corresponding to GPT-3 and DALL-E-2 into enterprise and client merchandise corresponding to 365 and Bing search. We count on commercialization and subsequent downstream utilization to additional profit your complete area.

We noticed a powerful turnaround in one of many worst-performing subsectors within the 12 months as much as Q3: Semiconductor (17% weighting), which was up 21%, with quickly rising publicity to IoT, Cloud, AI, and Automotive. We noticed additional cloud infrastructure CapEx and enormous venture bulletins, together with a $40 billion Taiwan Semiconductor 3nm chip fab in Arizona (additional benefiting fellow index members like ASML, Lam Analysis, and Teradyne).

The Client subsector (6% weighting) additionally noticed robust efficiency +13%, pushed by positive aspects from corporations like Reserving Holdings seeing robust bookings development, Netflix seeing robust web new subscribers and constructive growth on pricing fashions, and Digital Arts touchdown a Marvel partnership and seeing EPS steerage elevate. Client had been one of many first areas to get hit negatively by inflation fears and has since been among the many first to rebound.

Community & Safety (13% weighting), which had been the 12 months’s strongest performing subsector with combined efficiency, noticed just a few corporations like Crowdstrike, Rapid7, and Snowflake decline considerably on considerations over slowing development. We’re nonetheless inspired and have a powerful conviction right here as this space stays a precedence throughout governments and companies.

The most important laggard was Cognitive Computing, which was down 18% fully resulting from Tesla’s 54% drop in the course of the quarter. The market is realizing that Tesla isn’t the one EV participant anymore (market share within the US for EVs has declined 10% as incumbents and new gamers enter the area), whereas Elon Musk’s foray with Twitter hasn’t fully appeased shareholders both. We proceed to treat Tesla as a expertise and market chief.

HTEC: Healthcare Know-how & Innovation Index

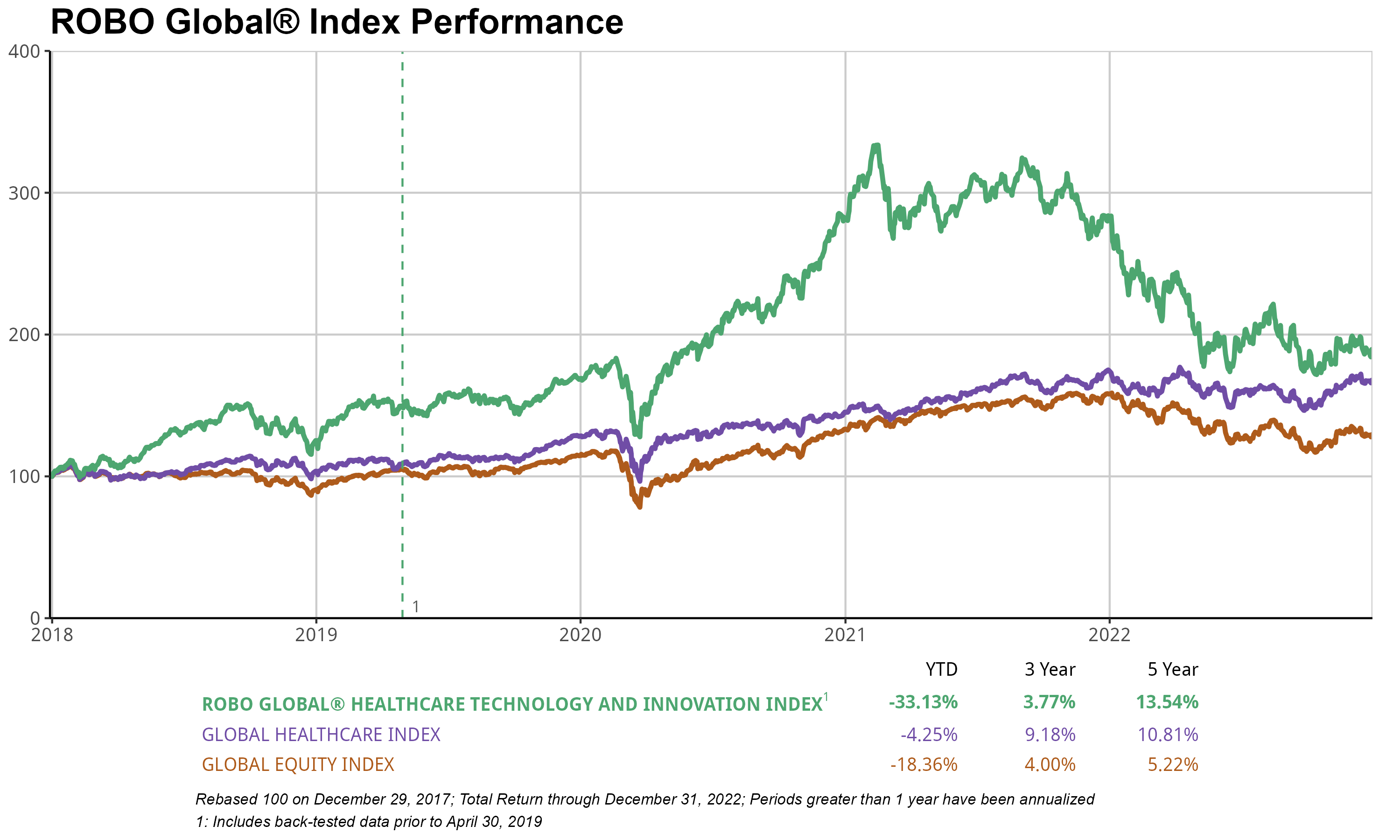

The ROBO International Healthcare Know-how & Innovation Index (HTEC) rose +6.9% in This fall, barely underperforming S&P International’s +7.5% achieve. Whereas a lot of the general public discourse has been targeted on Covid, innovation in healthcare continues at an accelerating tempo. For the 12 months ending 2022, the HTEC index declined 33%, underperforming main indices corresponding to S&P 500 and ACWI’s 18% decline. HTEC index was buying and selling on 4x Ahead EV/gross sales on the median, in comparison with the February 2021 excessive of seven.2x.

General, 2022 was a difficult 12 months for HTEC index members versus the worldwide market indices. Whereas there have been many robust performers in the course of the fourth quarter and 6 of the 9 sub-sectors posted constructive returns, HTEC declined ~33% for the 12 months in comparison with ACWI and S&P 500’s -18% decline.

Particularly, in the course of the fourth quarter, subsectors corresponding to Robotics, Medical Devices and Diagnostics posted stable positive aspects pushed by procedural restoration and M&A requirement for revolutionary cardiovascular options. Within the largest-ever acquisition within the MedTech business, J&J introduced its intent to accumulate HTEC index member Abiomed (+50%) for $16.6 billion. With 18 years of worthwhile development with its breakthrough applied sciences for coronary heart and lung help, Abiomed is disrupting the $77 billion cardiovascular business. Much less invasive options that permit for brief hospitalizations for improved outcomes stay a core emphasis within the HTEC portfolio. As well as, index members corresponding to JD Well being (+59%), Precise Science (+52%) and Tactile (+47%) additionally demonstrated outperformance in the course of the quarter as next-generation diagnostic options and scientific care options have been in robust demand because the world confirmed indicators of normalcy after lengthy intervals of covid lockdowns.

In the meantime, the Genomics subsector continues to be a combined bag with index members Guardant Well being (-49%) and Nanostring (-38%) have been beneath strain in the course of the quarter whereas Veracyte gained +43%. Particularly, Guardant Well being’s newest examine round their colorectal blood screening check introduced considerations in regards to the commercialization prospects. Whereas shares have been reset with this disappointing knowledge on efficacy charges, it’s going to nonetheless present much less invasive choices for a whole bunch of hundreds of individuals screening for colorectal most cancers yearly. On the constructive entrance, Veracyte raised its full-year 2022 forecast and posted a 25% Y/Y rise in quarterly income, helped by robust efficiency in its most cancers diagnostic assessments. Veracyte makes use of AI-enabled genomic expertise to hurry up medical analysis and supply earlier remedy for these at excessive danger for thyroid and prostate most cancers. Whereas the businesses in our Genomics sub-sector confirmed volatility prior to now 12 months, the extreme a number of compressions will present important upside alternatives for 2023. Lengthy-term drivers and demand for genomic applied sciences have solely strengthened our Genomic index members and. HTEC stays well-positioned.