U.Ok.-based Vodafone Group has agreed to depart the Hungarian telecom market after greater than 20 years of competing within the nation’s cellular and glued sectors.

On January 9, Antenna Hungaria, a subsidiary of Hungarian telecom and IT group 4iG, and the Hungarian authorities signed a purchase order settlement for 100% of Vodafone Hungary.

After due diligence, the events decided the enterprise worth of the goal firm at HUF660 billion ($1.8 billion).

4iG could have a 51% oblique curiosity in Vodafone Hungary through Antenna, whereas the federal government will maintain 49% by funding automobile Corvinus Worldwide Funding.

The transaction was first introduced again in August 2022, with a proposed sale value of HUF715 billion.

4iG and DIGI

4iG is already energetic within the Hungarian fastened broadband, cellular, and pay-TV markets through cable supplier and cellular community operator DIGI, a wholly-owned subsidiary of Antenna.

Antenna acquired DIGI from Romania’s Digi Communications in January 2022. 4iG has a 77% curiosity in Antenna, with the choice to extend to a most of 80%.

Within the cellular section, DIGI operates 2G and 4G networks, however wasn’t permitted to enter the March 2020 public sale of 5G licenses. DIGI now has a route into the 5G market, nevertheless, with new sister firm Vodafone among the many profitable bidders.

Within the fastened broadband market, DIGI operates cable, fiber-to-the-home, and broadband fastened wi-fi entry infrastructure.

In response to Vodafone, its Hungarian enterprise and DIGI have complementary suites of companies, and the mix of the 2 will create a stronger competitor to the incumbent operator.

4iG chairman Gellert Jaszai acknowledged, “The acquisition of Vodafone Hungary opens a brand new chapter within the Hungarian telecommunications market. It’s the first info-communications group in nearly thirty years that may function as a Hungarian majority-owned convergent operator.”

Jaszai then added: “The strategic cooperation between the Hungarian state and 4iG on this transaction is not going to solely remodel the market but in addition enhance competitiveness and speed up the digital transformation of the economic system.”

Vodafone Background

Vodafone Hungary launched a GSM-1800 community in 1999, later introducing 2100MHz 3G companies in December 2005.

The agency received 800MHz, 900MHz, and 2600MHz spectrum within the authorities’s September 2014 public sale of 4G licenses, and a industrial launch adopted two months later. Protection was initially restricted to Budapest, however the operator now covers greater than 98% of the nation’s inhabitants with its 4G sign.

Vodafone launched industrial 5G cellular companies throughout downtown Budapest in October 2019. It now affords 5G protection in additional than 150 cities and cities.

Vodafone launched industrial 5G cellular companies throughout downtown Budapest in October 2019. It now affords 5G protection in additional than 150 cities and cities.

Within the fastened sector, Hungary’s largest cable broadband operator, UPC, was taken over by Vodafone Group on July 31, 2019. This takeover was a part of a technique to combine UPC’s triple-play companies with Vodafone Hungary’s cellular operations, forming a stronger converged telecom competitor.

Starting September 2019, subscribers taking a number of UPC cable web/fastened voice/TV companies alongside a Vodafone cellular package deal got month-to-month reductions. Additionally they acquired varied different advantages like bonus cellular information, data-free utilization of cellular TV, and limitless on-net telephone calls.

All UPC fastened broadband, cable TV, fastened voice, and cellular companies have been marketed below the Vodafone model since April 2020, and the UPC and Vodafone web sites at the moment are built-in.

Present Market Standing

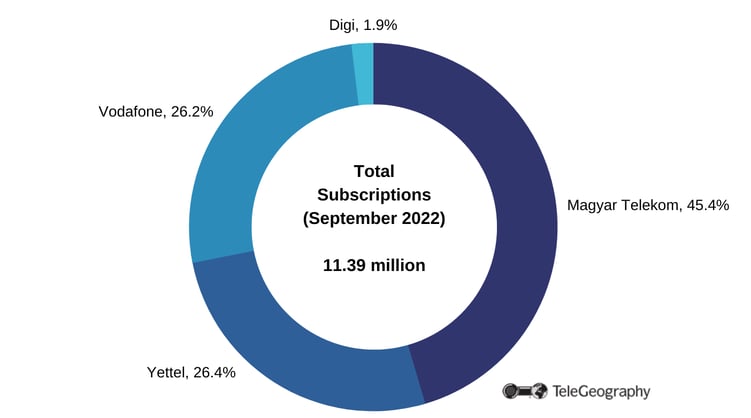

Hungary’s cellular sector is residence to 4 community operators, which served a complete of 11.39 million subscriptions on the finish of September 2022, in line with TeleGeography’s GlobalComms Database.

Hungary Cellular Market, September 2022

Magyar Telekom, managed by Deutsche Telekom of Germany, has 45% of the market in subscription phrases. Yettel (previously Telenor Hungary) and Vodafone every have round 26% of subscriptions. DIGI accounts for the small the rest.

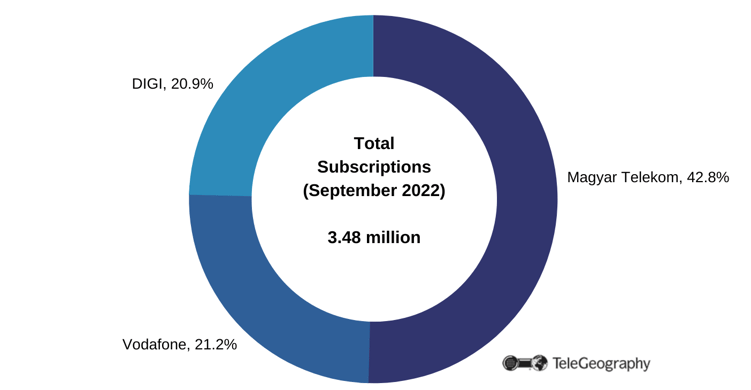

Hungary Mounted Broadband Market, September 2022

The fastened broadband market can be led by Magyar Telekom with a 43% share of retail subscriptions. Vodafone and DIGI every maintain shares of round 21%. There have been 3.48 million fastened broadband subscriptions on the finish of September 2022.

Regulatory Inexperienced Gentle

On January 10, the Hungarian authorities declared the Vodafone takeover to be a transaction of strategic nationwide curiosity, thereby exempting the deal from investigation by competitors authorities.

The federal government stated 4iG’s acquisition of the Vodafone stake served the nation’s “safety of telecoms companies provide” and would subsequently qualify as a deal of “nationwide strategic significance.”

The takeover is predicted to be accomplished by the tip of January 2023.

Vodafone Hungary, September 2022

| Cellular Subscriptions | 2,989,000 |

| Cellular Market Share | 26.2% |

| Mounted Broadband Subscriptions | 737,000 |

| Mounted Broadband Market Share | 21.2% |