Out of all of the awfulness created by the COVID-19 international pandemic, a couple of surprising silver linings have emerged. One in all them is within the area of economics, which up to now 12 months has quietly undergone a revolution, a revolution that mirrors one that’s occurring within the enterprise world.

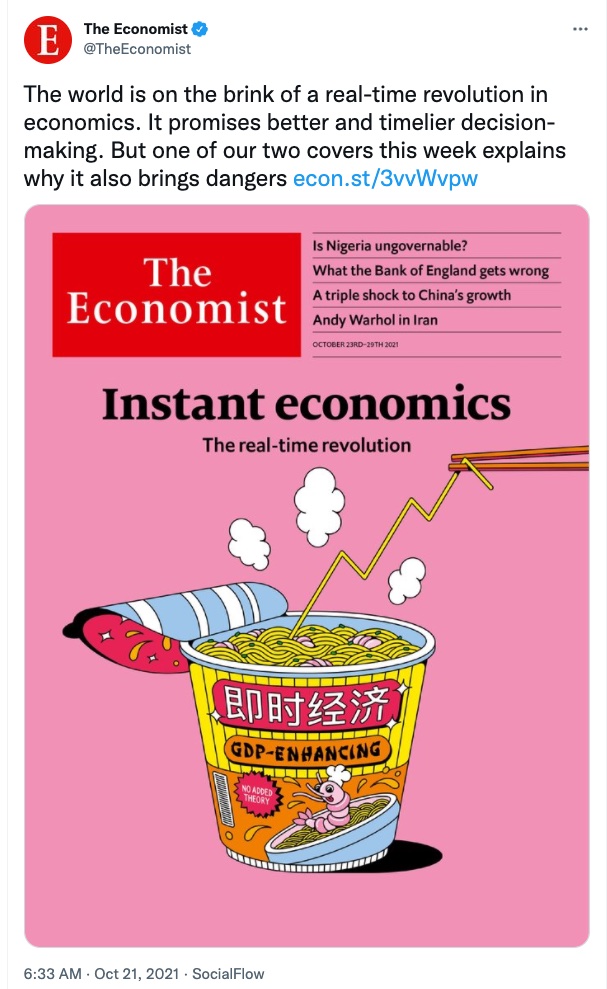

To an outsider, economics is a area dominated by numbers and statistics. Nonetheless, because the Economist journal identified in its latest cowl story, “Instantaneous Economics: The Actual-Time Revolution,” there has lengthy been a startling scarcity of well timed knowledge and statistics within the precise apply of economics — particularly its most-critical and glamorous speciality, financial forecasting.

(The Economist: An actual-time revolution will up-end the apply of macroeconomics)

Governments use macroeconomic forecasts to information their policymaking. Will one other rate of interest minimize jumpstart a flagging economic system? How a lot unemployment will consequence from elevating the minimal wage to X {dollars} per hour?

Previous to the twentieth century, classical economists — suppose Adam Smith or Thomas Malthus — created grand, unified theories. Nonetheless, knowledge was so scarce and spotty that their treatises learn extra like philosophy than trendy economics. Greater than half of the economics papers revealed within the Nineteen Seventies lacked any numerical knowledge, in keeping with the Economist. Even in the present day, key statistics equivalent to nationwide GDP or unemployment charges take weeks and months to gather, revise, and finalize. Extra advanced figures equivalent to productiveness charges take even longer.

That time-frame is okay for economics professors, however too gradual for policymakers. The issue stays two-fold: official authorities statistics take too lengthy to emerge, particularly in crises, and the levers on the disposal of policymakers are too blunt and gradual.

“Conventional authorities statistics weren’t actually all that useful — by the point they got here out, the information have been stale,” a former U.S. assistant treasury secretary advised the Economist.

Confronted with this knowledge dilemma, some economists retreat again to idea and beliefs. Provide siders pushed for chopping taxes and rules, whereas demand-siders argued for larger taxes and authorities spending.

Others mined real-time indicators equivalent to inventory and bond market costs. Whereas these have the advantage of mining the knowledge of crowds, they’re additionally weak to an entire set of accuracy-reducing elements: market manipulation, unwarranted investor confidence or panic, points explicit to at least one firm or business, and so forth.

Stale Knowledge Prices Trillions of {Dollars}

“It is just a slight exaggeration to say that central banks are flying blind,” wrote the Economist. Consequently, “dangerous and late knowledge can result in coverage errors that price tens of millions of jobs and trillions of {dollars} in misplaced output.”

And that’s precisely what occurred throughout the 2008 recession. As TV speaking heads referred to stale financial knowledge displaying every part was A-OK, housing costs plummeted, foreclosures skyrocketed, and the economic system tanked. Banks have been too large to fail, till they abruptly weren’t. The dearth of dependable, recent knowledge led to dangerous coverage choices that worsened the recession.

When COVID-19 hit, a brand new wave of economists and policymakers have been decided to keep away from the errors of 2008.

“With out the time to attend for official surveys to disclose the results of the virus or lockdowns, governments and central banks have experimented, monitoring cell phones, contactless funds, and the real-time use of plane engines,” wrote the Economist. “As a substitute of locking themselves of their research for years writing the following ‘Common Principle,’ in the present day’s star economists, equivalent to Raj Chetty at Harvard College, run well-staffed labs that crunch numbers.” If Netflix is aware of precisely which exhibits are trending, why can’t policy-makers get a greater pulse of the economic system as issues unfold?

More energizing Analytics for Quicker Actions

The place is that this new wave of economists getting these knowledge units?

More energizing analytics means quicker actions. The primary evaluation of the impact of America’s $600 stimulus checks was revealed in mere weeks. Inside a month, the UK authorities confirmed {that a} coverage to deliver prospects again to eating places additionally elevated the variety of COVID infections. Economists confirmed the massive variety of staff taking their jobs on the highway partially from social media posts embracing #vanlife.

“The age of bewilderment is beginning to give approach to a better enlightenment,” declared the Economist.

And that has led to focused, quickly-deployed financial insurance policies. The American stimulus invoice included particular help for eating places due partially to the OpenTable.com knowledge. In Hong Kong, the federal government is sending money electronically to the digital wallets of its residents, money that may expire if not spent by a sure date. Utilizing analytics, related on the spot money handouts might be mechanically despatched out to poor individuals who have misplaced their jobs with out the necessity for them to file any paperwork. Or loans might be immediately provided to companies which can be decided to be low chapter dangers.

Distinction that with broad-based financial insurance policies equivalent to rate of interest cuts, which take a number of quarters to take full impact, have many unintended negative effects, and might result in main victories — or be huge misses.

Digital Economics for Extra Correct, Clear Insurance policies

Economists and authorities policymakers haven’t caught as much as cutting-edge companies which have made the transformation into digital enterprises. Knowledge latency is the obvious space. To make sure knowledge reliability and high quality, Google, OpenTable and others are nonetheless publishing their datasets in a single day, somewhat than pumping out dwell streams.

However extra dwell and real-time sources of knowledge are rising. India recorded 25.6 billion real-time digital funds final 12 months. IoT sensors are being fitted to machines and objects at a quick charge. And greater than 50 international locations, together with China, are trialing central financial institution digital currencies (CBDCs), often known as GovCoins, as dietary supplements to paper cash. In contrast to Bitcoin and different anonymity-promising cryptocurrencies, GovCoins can be trackable by their authorities issuers — a boon for policymakers, although a minus for privacy-concerned people.

There are different potential pitfalls of the brand new digital economics. Signalling directional adjustments within the economic system is nice, however quantifying precise GDP output or unemployment charges is a more durable drawback. There are perpetual points of knowledge relevance and knowledge drift. Is a downturn in Uber automobile sharing journeys a distant early warning of a worldwide recession, or just the results of an organization misstep? And is knowledge revealed by companies tainted with an optimistic bias? These are all official considerations, and ones with which our prospects within the enterprise world rightly should additionally wrestle.

Nonetheless, “these developments will intensify as know-how permeates the economic system,” writes the Economist. Meaning extra and more energizing datasets that may be mixed in artistic methods to supply fast however informative financial coverage insights.

This mirrors precisely what I see within the enterprise world. The continuing shift from historic analytics utilizing knowledge warehousing to real-time analytics utilizing extra trendy knowledge stacks has unlocked a wealth of alternatives for companies to make smarter, data-driven choices quicker than ever.

“The actual-time revolution guarantees to make financial choices extra correct, clear, and rules-based,” writes the Economist. I couldn’t agree extra.

Rockset is the real-time analytics database within the cloud for contemporary knowledge groups. Get quicker analytics on more energizing knowledge, at decrease prices, by exploiting indexing over brute-force scanning.