Identification thieves have been exploiting a evident safety weak point within the web site of Experian, one of many massive three shopper credit score reporting bureaus. Usually, Experian requires that these looking for a duplicate of their credit score report efficiently reply a number of a number of alternative questions on their monetary historical past. However till the top of 2022, Experian’s web site allowed anybody to bypass these questions and go straight to the patron’s report. All that was wanted was the individual’s identify, handle, birthday and Social Safety quantity.

The vulnerability in Experian’s web site was exploitable after one utilized to see their credit score file through annualcreditreport.com.

In December, KrebsOnSecurity heard from Jenya Kushnir, a safety researcher residing in Ukraine who mentioned he found the strategy being utilized by id thieves after spending time on Telegram chat channels devoted to the cashing out of compromised identities.

“I need to attempt to assist to place a cease to it and make it harder for [ID thieves] to entry, since [Experian is] not doing shit and common individuals wrestle,” Kushnir wrote in an e-mail to KrebsOnSecurity explaining his motivations for reaching out. “If someway I could make small change and assist to enhance this, inside myself I can really feel that I did one thing that really issues and helped others.”

Kushnir mentioned the crooks realized they may trick Experian into giving them entry to anybody’s credit score report, simply by modifying the handle displayed within the browser URL bar at a particular level in Experian’s id verification course of.

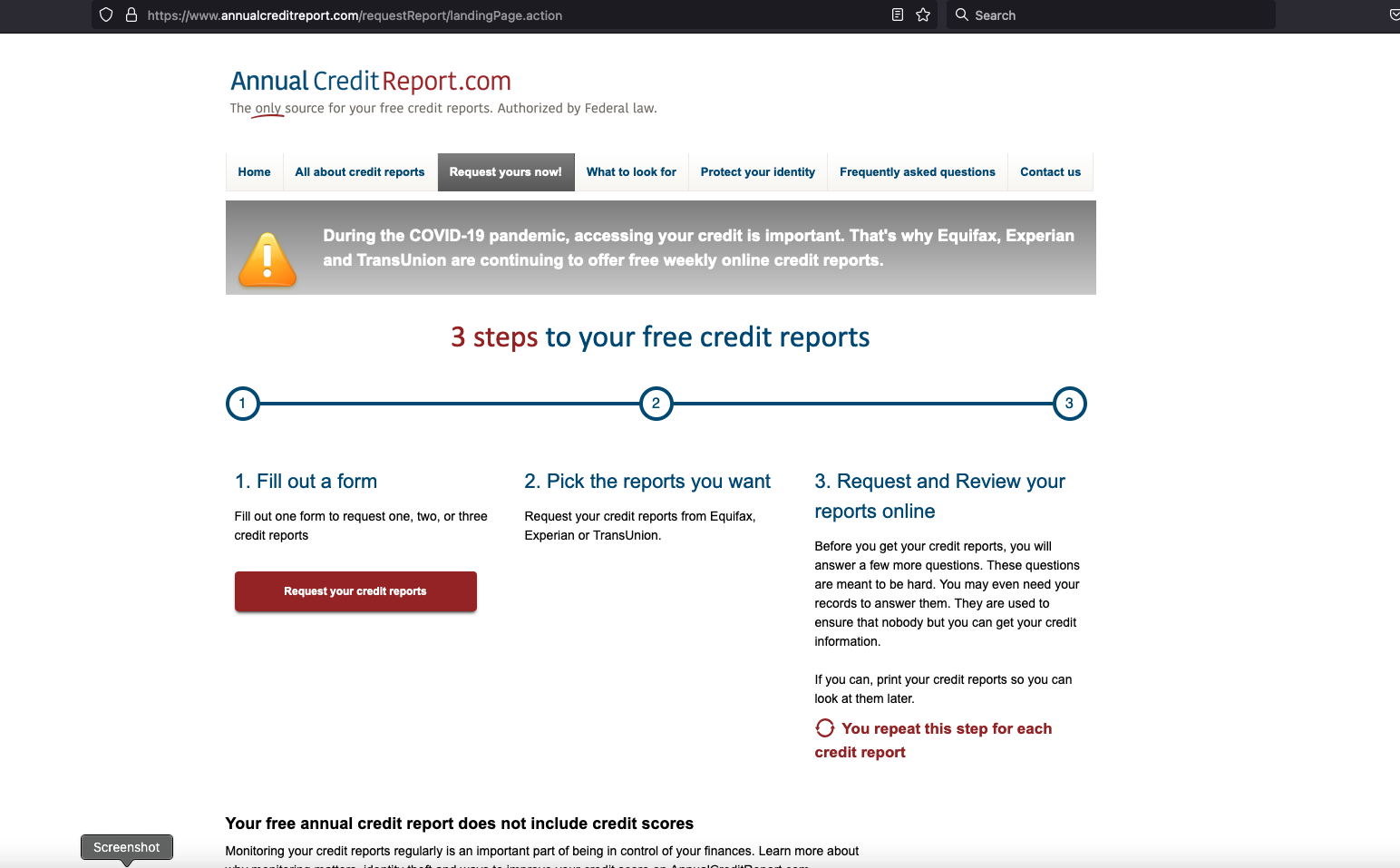

Following Kushnir’s directions, I sought a duplicate of my credit score report from Experian through annualcreditreport.com — an internet site that’s required to offer all Individuals with a free copy of their credit score report from every of the three main reporting bureaus, as soon as per 12 months.

Annualcreditreport.com begins by asking on your identify, handle, SSN and birthday. After I equipped that and advised Annualcreditreport.com I needed my report from Experian, I used to be taken to Experian.com to finish the id verification course of.

Usually at this level, Experian’s web site would current 4 or 5 multiple-guess questions, corresponding to “Which of the next addresses have you ever lived at?”

Kushnir advised me that when the questions web page masses, you merely change the final a part of the URL from “/acr/oow/” to “/acr/report,” and the positioning would show the patron’s full credit score report.

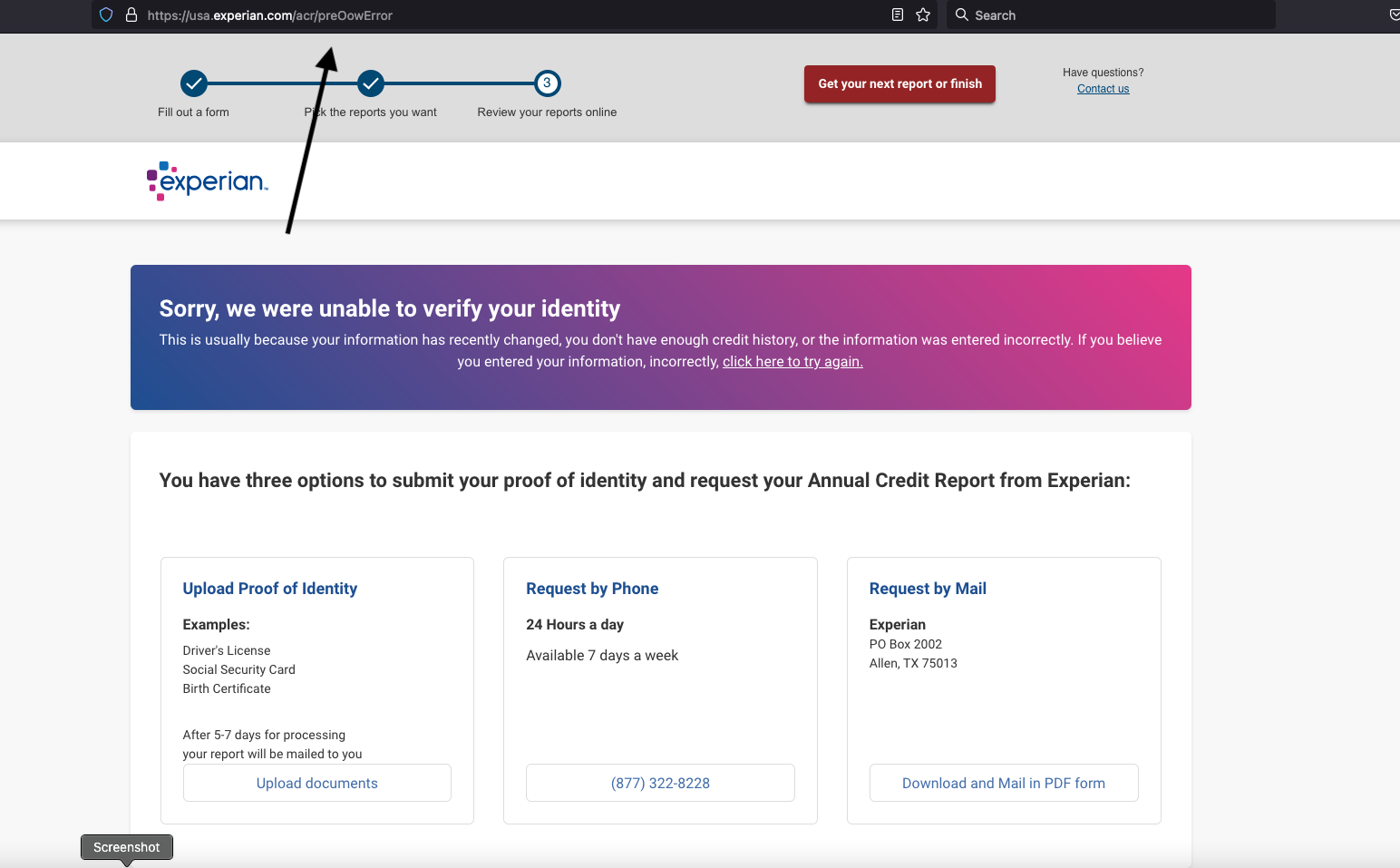

However after I tried to get my report from Experian through annualcreditreport.com, Experian’s web site mentioned it didn’t have sufficient data to validate my id. It wouldn’t even present me the 4 multiple-guess questions. Experian mentioned I had three choices for a free credit score report at this level: Mail a request together with id paperwork, name a cellphone quantity for Experian, or add proof of id through the web site.

However that didn’t cease Experian from exhibiting me my full credit score report after I modified the Experian URL as Kushnir had instructed — modifying the error web page’s trailing URL from “/acr/OcwError” to easily “/acr/report”.

Experian’s web site then instantly displayed my total credit score file.

Though Experian mentioned it couldn’t inform that I used to be really me, it nonetheless coughed up my report. And thank goodness it did. The report comprises so many errors that it’s in all probability going to take a great deal of effort on my half to straighten out.

Now I do know why Experian has NEVER let me view my very own file through their web site. For instance, there have been 4 cellphone numbers on my Experian credit score file: Solely one among them was mine, and that one hasn’t been mine for ages.

I used to be so dumbfounded by Experian’s incompetence that I requested an in depth buddy and trusted safety supply to strive the strategy on her id file at Experian. Certain sufficient, when she obtained to the half the place Experian requested questions, altering the final a part of the URL in her handle bar to “/report” bypassed the questions and instantly displayed her full credit score report. Her report additionally was replete with errors.

KrebsOnSecurity shared Kushnir’s findings with Experian on Dec. 23, 2022. On Dec. 27, 2022, Experian’s PR group acknowledged receipt of my Dec. 23 notification, however the firm has to this point ignored a number of requests for remark or clarification.

By the point Experian confirmed receipt of my report, the “exploit” Kushnir mentioned he realized from the id thieves on Telegram had been patched and now not labored. However it stays unclear how lengthy Experian’s web site was making it really easy to entry anybody’s credit score report.

In response to data shared by KrebsOnSecurity, Senator Ron Wyden (D-Ore.) mentioned he was disillusioned — however under no circumstances stunned — to listen to about one more cybersecurity lapse at Experian.

“The credit score bureaus are poorly regulated, act as if they’re above the regulation and have thumbed their noses at Congressional oversight,” Wyden mentioned in a written assertion. “Simply final 12 months, Experian ignored repeated briefing requests from my workplace after you revealed one other cybersecurity lapse the corporate.”

Sen. Wyden’s quote above references a narrative printed right here in July 2022, which broke the information that id thieves had been hijacking shopper accounts at Experian.com simply by signing up as them at Experian as soon as extra, supplying the goal’s static, private data (identify, DoB/SSN, handle) however a special e-mail handle.

From interviews with a number of victims who contacted KrebsOnSecurity after that story, it emerged that Experian’s personal buyer help representatives had been really telling customers who obtained locked out of their Experian accounts to recreate their accounts utilizing their private data and a brand new e-mail handle. This was Experian’s recommendation even for individuals who’d simply defined that this technique was what id thieves had used to lock them in out within the first place.

Clearly, Experian discovered it easier to reply this manner, slightly than acknowledging the issue and addressing the basis causes (lazy authentication and abhorrent account restoration practices). It’s additionally price mentioning that reviews of hijacked Experian.com accounts endured into late 2022. That screw-up has since prompted a category motion lawsuit towards Experian.

Sen. Wyden mentioned the Federal Commerce Fee (FTC) and Client Monetary Safety Bureau (CFPB) have to do way more to guard Individuals from screw-ups by the credit score bureaus.

“In the event that they don’t imagine they’ve the authority to take action, they need to endorse laws like my Thoughts Your Personal Enterprise Act, which provides the FTC energy to set robust necessary cybersecurity requirements for corporations like Experian,” Wyden mentioned.

Sadly, none of that is terribly stunning habits for Experian, which has proven itself a totally negligent custodian of obscene quantities of extremely delicate shopper data.

In April 2021, KrebsOnSecurity revealed how id thieves had been exploiting lax authentication on Experian’s PIN retrieval web page to unfreeze shopper credit score recordsdata. In these instances, Experian didn’t ship any discover through e-mail when a freeze PIN was retrieved, nor did it require the PIN to be despatched to an e-mail handle already related to the patron’s account.

A couple of days after that April 2021 story, KrebsOnSecurity broke the information that an Experian API was exposing the credit score scores of most Individuals.

It’s dangerous sufficient that we are able to’t actually decide out of corporations like Experian making $2.6 billion every quarter gathering and promoting gobs of our private and monetary data. However there needs to be some significant accountability when these monopolistic corporations interact in negligent and reckless habits with the exact same shopper information that feeds their quarterly earnings. Or when safety and privateness shortcuts are discovered to be intentional, like for cost-saving causes.

And as we noticed with Equifax’s consolidated class-action settlement in response to letting state-sponsored hackers from China steal information on practically 150 million Individuals again in 2017, class-actions and extra laughable “free credit score monitoring” companies from the exact same corporations that created the issue aren’t going to chop it.

WHAT CAN YOU DO?

It’s simple to undertake a defeatist angle with the credit score bureaus, who typically foul issues up royally even for customers who’re fairly diligent about watching their shopper credit score recordsdata and disputing any inaccuracies.

However there are some concrete steps that everybody can take which is able to dramatically decrease the danger that id thieves will damage your monetary future. And fortunately, most of those steps have the aspect good thing about costing the credit score bureaus cash, or a minimum of inflicting the information they acquire about you to develop into much less worthwhile over time.

Step one is consciousness. Discover out what these corporations are saying about you behind your again. Remember that — honest or not — your credit score rating as collectively decided by these bureaus can have an effect on whether or not you get that mortgage, residence, or job. In that context, even small, unintentional errors which are unrelated to id theft can have outsized penalties for customers down the street.

Every bureau is required to offer a free copy of your credit score report yearly. The simplest option to get yours is thru annualcreditreport.com.

Some customers report that this website by no means works for them, and that every bureau will insist they don’t have sufficient data to offer a report. I’m undoubtedly on this camp. Fortunately, a monetary establishment that I have already got a relationship with affords the flexibility to view your credit score file by them. Your mileage on this entrance might range, and chances are you’ll find yourself having to ship copies of your id paperwork by the mail or web site.

Whenever you get your report, search for something that isn’t yours, after which doc and file a dispute with the corresponding credit score bureau. And after you’ve reviewed your report, set a calendar reminder to recur each 4 months, reminding you it’s time to get one other free copy of your credit score file.

In case you haven’t already accomplished so, think about making 2023 the 12 months that you just freeze your credit score recordsdata on the three main reporting bureaus, together with Experian, Equifax and TransUnion. It’s now free to individuals in all 50 U.S. states to position a safety freeze on their credit score recordsdata. It is usually free to do that on your companion and/or your dependents.

Freezing your credit score means nobody who doesn’t have already got a monetary relationship with you possibly can view your credit score file, making it unlikely that potential collectors will grant new traces of credit score in your identify to id thieves. Freezing your credit score file additionally means Experian and its brethren can now not promote peeks at your credit score historical past to others.

Anytime you want to apply for brand spanking new credit score or a brand new job, or open an account at a utility or communications supplier, you possibly can rapidly thaw a freeze in your credit score file, and set it to freeze routinely once more after a specified size of time.

Please don’t confuse a credit score freeze (a.okay.a. “safety freeze”) with the choice that the bureaus will seemingly steer you in direction of whenever you ask for a freeze: “Credit score lock” companies.

The bureaus pitch these credit score lock companies as a approach for customers to simply toggle their credit score file availability with push of a button on a cellular app, however they do little to stop the bureaus from persevering with to promote your data to others.

My recommendation: Ignore the lock companies, and simply freeze your credit score recordsdata already.

One closing word. Frequent readers right here can have seen that I’ve criticized these so-called “knowledge-based authentication” or KBA questions that Experian’s web site didn’t ask as a part of its shopper verification course of.

KrebsOnSecurity has lengthy assailed KBA as weak authentication as a result of the questions and solutions are drawn largely from shopper data which are public and simply accessible to organized id theft teams.

That mentioned, provided that these KBA questions seem like the ONLY factor standing between me and my Experian credit score report, it looks as if perhaps they need to a minimum of take care to make sure that these questions really get requested.