In only a decade, smartphones have change into an integral a part of our fashionable existence. We work, financial institution, pay, and play on them. Devour video games, movie, and music, socialize and join, domestically and globally.

It’s estimated that there at the moment are 6.648 Billion smartphone customers worldwide, with world penetration within the mid-80%. That’s a number of cell phones, and a number of client site visitors representing an enormous 24/7 channel for B2C and B2B retailers, particularly these with apps.

Apps are booming however gatekeepers’ have management

App development can also be skyrocketing. The worldwide cell utility market measurement was estimated at US$187.58 billion in 2021 and is anticipated to achieve US$ 206.73 billion in 2022.

Regardless of demand, most apps are nonetheless solely accessible via app shops which act because the gatekeepers for smartphone software program. The Google Play Retailer and the Apple App Retailer are the largest of those and signify a mixed whole of over 5.6 million Android and iOS apps worldwide.

These seeking to promote app-based digital merchandise and providers via these channels have confronted restrictions on their use of third-party cost methods. As a substitute, they’ve been pressured to make use of Apple and Google’s proprietary cost platform inside their apps.

Whereas person security is cited as the first purpose for this, it has nonetheless left app shops free to dictate phrases and reap profitable commissions, sometimes 30% of each transaction. Till now, app builders, have had little possibility aside from to just accept this large hit as a price of sale.

The stranglehold on funds is beginning to loosen

In March 2022, Google Play Retailer introduced trials to just accept third-party cost strategies from different sources – however provided that supplied alongside the Google possibility. Builders should nonetheless pay the app retailer charge albeit at a 4% low cost. In the meantime, Apple continues to be sticking to its ‘no third-party funds’ place, regardless of rising stress from varied authorized actions.

Because the business waits for the ultimate ruling on the long-drawn-out Epic vs Apple case, South Korea has already handed an antitrust legislation that impacts each Apple and Google. In the meantime, within the Netherlands, Dutch courting apps can now skip Apple’s in-app cost methods because of a brand new anti-competitive ruling.

Different international locations might quickly observe swimsuit with extra authorized challenges. This might quickly open the door to larger income alternatives for app builders – and a complete new raft of SaaS apps which are ripe for lower-cost cost integration.

Integrating third-party in-app funds might change into central to cell subscription and gross sales methods in 2023

However including funds to an present app will be a lot trickier than builders assume. There’s extra to it than including a pop-up kind and a few back-end code. There’s additionally the not-so-simple situation of laws and necessities to think about in addition to the fixed updates which are required.

For these used to plugging straight into Apple and Google funds platforms, the hot button is understanding how funds works within the wider world. This consists of the events concerned, the totally different cost rails, and transaction flows. And, after all, the safety processes that preserve the whole lot compliant, like PCI DSS and PSD2 SCA (Sturdy Buyer Authentication) which requires two issue authentication for on-line transactions in Europe and the UK (with some exemptions and exceptions).

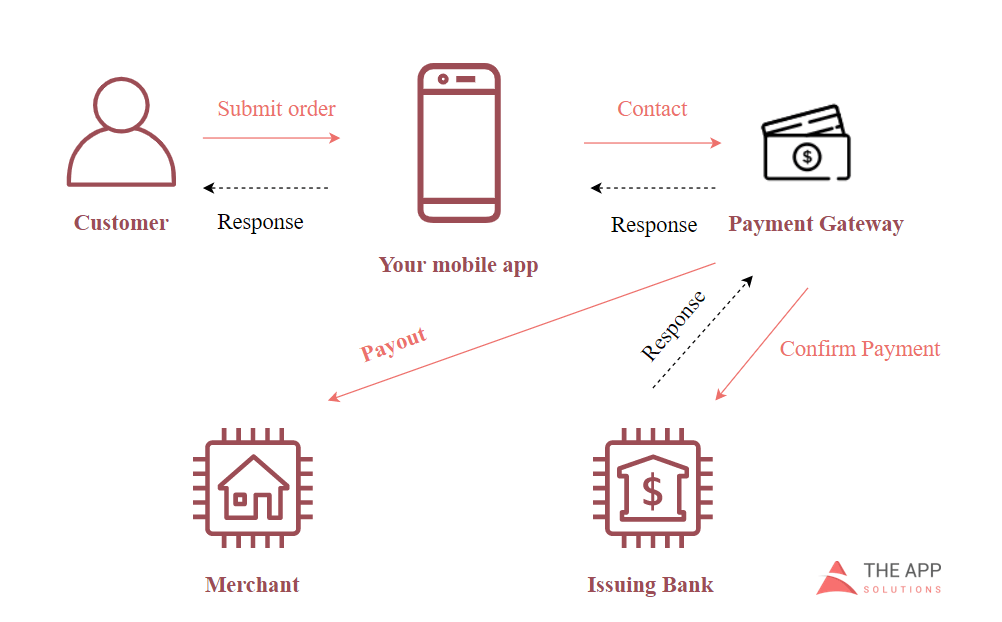

In-app transaction path and individuals

In a typical in-app transaction (see diagram), the app sends a request to the cost gateway, which then additional communicates with the person’s card issuing financial institution and the service provider to authorize the transaction and settle the cash into the vendor’s checking account.

SaaS builders will need assistance and assist

Though SaaS companies could have skilled app programmers, they could be unfamiliar with this new ecosystem, the nomenclature and workflows. Equally, they could not have the SDKs available to ship quick implementation.

That’s the place having a specialist cost companion is available in. They can assist do a number of the heavy lifting. Offering the required platforms and SDKs that builders can use to simplify integration, go to market quicker and assist make subscriptions and in-app purchases smoother.

What builders can anticipate to realize

So, what occurs if app shops open funds up? Utilizing a cost system of alternative for SaaS cell apps will enable builders to keep up a seamless person expertise, with out having to pay as much as 30% of each sale.

Different third-party suppliers are more likely to supply way more aggressive charge buildings, particularly for decrease worth transactions. Which means builders and retailers might probably earn extra from each buy, which might have a big impact on their backside line, and long-term viability.

There are a number of different benefits available by shifting to an alternate cost resolution somewhat than sticking with the App Retailer established order. Listed here are our high 5:

1. Superior monetization instruments

Builders could have entry to a wider vary of choices to assist increase AOV/ARPU for customers by encouraging upselling, cross-selling, and promotions.

2. Extra versatile pricing and packaging

A devoted cost system built-in into the app permits retailers to higher match worth with client perceived worth. For instance, tiered pricing and usage-based pricing, in addition to trials, renewal reductions and incentives that assist drive app retailer optimization.

3. Elevated due income

Most recurring income corporations take into account dunning an essential a part of their income restoration technique. Having built-in in-app funds with extra streamlined dunning processes can assist enhance communication with clients so builders can get better extra due income from exhausting declines to reduce buyer churn.

4. Extra cost alternative for purchasers

Clients need extra alternative on the checkout. In lots of international locations, different funds and digital wallets now rival playing cards. With extra choices to discover, builders can higher localize their apps for person relevance to assist increase conversion charges.

5. Higher assist and safety

In addition to providing options, third-party cost suppliers also can present skilled recommendation and compliance assist – from the newest authorization methods and safety options to one of the best use of AI and ML pushed anti-fraud methods.

It’s time to democratize in-app funds

Because the European Parliament’s proposed Digital Markets Act will get prepared to control the remedy of funds inside cell platform shops, it might not be too lengthy earlier than we see a wholescale shift in in-app cost fashions throughout Europe.

Some companies are already preempting regulation and dealing to get forward of the curve.

They’re on the point of promote different cost strategies in-app utilizing a number of funds gateways (together with Direct Service Billing) to allow them to cut back their prices with cost processors.

Proudly owning funds from the underside up is sensible for builders – it reduces friction, creates a greater UX and creates extra buy alternative for his or her app customers. It additionally unlocks new alternatives for income uplift for retailers throughout the digital commerce lifecycle, from acquisition to activation, improve, and renewal.

Taking the primary steps

To intergrade in-app funds, builders will want a dependable processor to behave as an middleman between the service provider and the opposite monetary establishments concerned.

Earlier than deciding:

- Make clear and perceive pricing fashions, together with charges per transaction, minimal and most quantities.

- Examine that their resolution is 100% compatibility along with your chosen CMS/e-commerce platform.

- Affirm that they’ll assist all of the cost platforms required – not simply playing cards and PayPal but in addition any native strategies or APMs which are essential in your audiences.

- Ensure you can present the crucial inner useful resource to handle the connection and allocate assist for funds internally.

Keep forward of the curve

Having the best technique and companions in place will assist builders rapidly make the most of any rest in app retailer funds restrictions as they occur, to allow them to reap the benefit sooner and steal a lead on the competitors.