Thousands and thousands of individuals seemingly simply acquired an e mail or snail mail discover saying they’re eligible to say a category motion cost in reference to the 2017 megabreach at shopper credit score bureau Equifax. Given the excessive quantity of reader inquiries about this, it appeared price stating that whereas this explicit provide is legit (if paltry), scammers are prone to quickly capitalize on public consideration to the settlement cash.

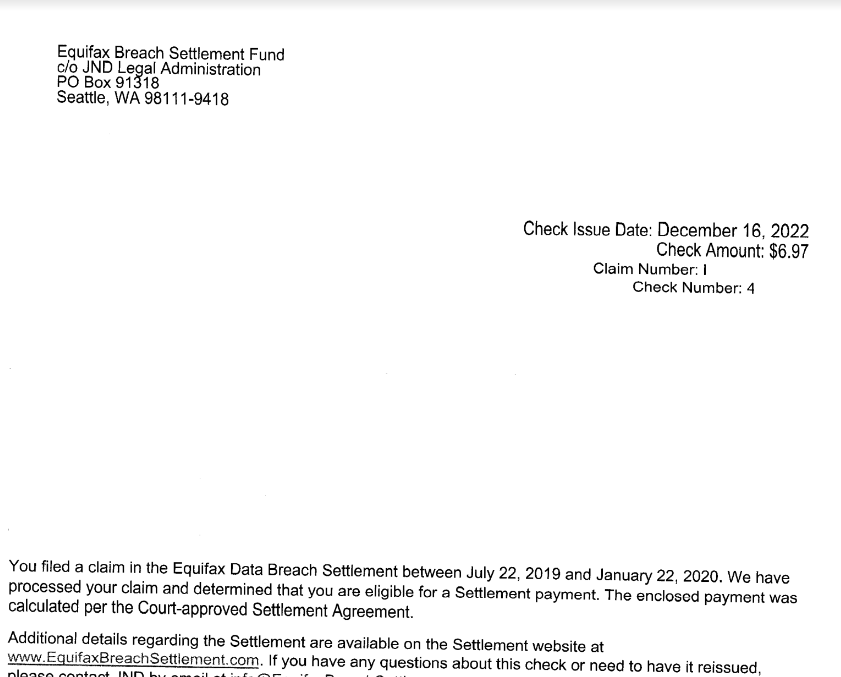

One reader’s copy of their Equifax Breach Settlement letter. They acquired a test for $6.97.

In 2017, Equifax disclosed an enormous, prolonged knowledge breach that led to the theft of Social Safety Numbers, dates of beginning, addresses and different private data on almost 150 million individuals. Following a public breach response maybe greatest described as an enormous dumpster hearth, the big-three shopper credit score reporting bureau was shortly hit with almost two dozen class-action lawsuits.

In trade for resolving all excellent class motion claims in opposition to it, Equifax in 2019 agreed to a settlement that features as much as $425 million to assist individuals affected by the breach.

Affected shoppers had been eligible to use for not less than three years of credit score monitoring by way of all three main bureaus concurrently, together with Equifax, Experian and Trans Union. Or, in the event you didn’t wish to reap the benefits of the credit score monitoring gives, you might go for a money cost of as much as $125.

The settlement additionally provided reimbursement for the time you might have spent remedying identification theft or misuse of your private data brought on by the breach, or buying credit score monitoring or credit score experiences. This was capped at 20 whole hours at $25 per hour ($500), with whole money reimbursement funds to not exceed $20,000 per shopper.

Those that did file a declare most likely began receiving emails or different communications earlier this 12 months from the Equifax Breach Settlement Fund, which has been messaging class members about strategies of accumulating their funds.

How a lot every recipient receives seems to fluctuate fairly a bit, however most likely most individuals may have earned a cost on the smaller finish of that $125 scale — like lower than $10. Those that acquired increased quantities seemingly spent extra time documenting precise losses and/or explaining how the breach affected them personally.

Thus far this week, KrebsOnSecurity has acquired not less than 20 messages from readers looking for extra details about these notices. Some readers shared copies of letters they received within the mail together with a paper test from the Equifax Breach Settlement Fund (see screenshot above).

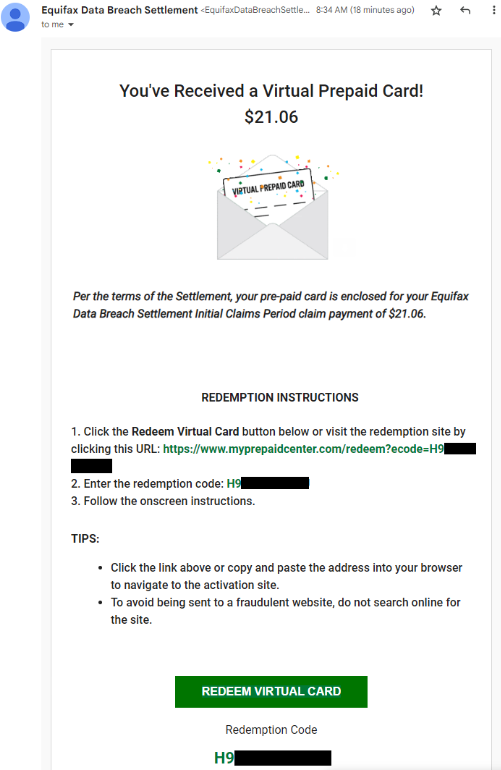

Others stated they received emails from the Equifax Breach Settlement area that regarded like an animated greeting card providing directions on redeem a digital pay as you go card.

In case you acquired certainly one of these settlement emails and are cautious about clicking the included hyperlinks (good for you, by the way in which), copy the redemption code and paste it into the search field at myprepaidcenter.com/redeem. Efficiently finishing the cardboard software requires accepting a pay as you go MasterCard settlement (PDF).

The web site for the settlement — equifaxbreachsettlement.com — additionally features a lookup instrument that lets guests test whether or not they had been affected by the breach; it requires your final identify and the final six digits of your Social Safety Quantity.

In February 2020, the U.S. Justice Division indicted 4 Chinese language officers of the Individuals’s Liberation Military (PLA) for perpetrating the 2017 Equifax hack. DOJ officers stated the 4 males had been accountable for finishing up the biggest theft of delicate private data by state-sponsored hackers ever recorded.

Equifax surpassed Wall Road’s expectations in its most up-to-date quarterly earnings: The corporate reported revenues of $1.24 billion for the quarter ending September 2022.

After all, most of these earnings come from Equifax’s continued authorized capacity to purchase and promote eye-popping quantities of monetary and private knowledge on U.S. shoppers. As one of many three main credit score bureaus, Equifax collects and packages details about your credit score, wage, and employment historical past. It tracks what number of bank cards you have got, how a lot cash you owe, and the way you pay your payments. Every firm creates a credit score report about you, after which sells this report back to companies who’re deciding whether or not to present you credit score.

People at the moment haven’t any authorized proper to decide out of this knowledge assortment and commerce. However you can and in addition ought to and freeze your credit score, which by the way in which could make your credit score profile much less worthwhile for firms like Equifax — as a result of they generate profits each time some potential creditor needs a peek inside your monetary life. Additionally, it’s most likely a good suggestion to freeze the credit score of your kids and/or dependents as properly. It’s free on each counts.