Earnings Tax is a direct tax, that’s, levied on any particular person’s or entity’s earnings throughout a monetary yr. It’s instantly paid to the federal government, like all the opposite direct taxes. The online taxable earnings is taken into account to calculate the tax legal responsibility of the person or entity primarily based on the earnings slabs offered by the Earnings-tax Division for the present monetary yr. The quantity of tax paid relies on the cash earned by the person in that specific monetary yr.

Earnings tax on Wage:

The compensation acquired towards providers offered in reference to employment by an worker from a present or former employer is termed Wage. Part 15 of the Earnings Tax Act gives for the tax levied on wage. In response to Earnings Tax Act, the time period Wage contains Wages, Annuity or Pension, Gratuity, Charges, Commissions, Perquisites or Income (Along with wage/wages), Advance of Wage, Encashed Earned Leaves, Contribution in Provident Fund (as much as the extent it’s taxable), Contribution in Pension Scheme (confer with part 80CCD, i.e., NPS), and so forth.

Taxability of Varied Wage Elements:

Earnings Tax Slab Charges for Salaried Staff:

The quantity of tax one must pay relies upon upon the earnings tax bracket the particular person is falling into. Any particular person with an annual earnings of greater than Rs. 5 Lakh must pay Earnings tax to the federal government in response to the Earnings Tax Act.

Within the Union Finances 2020, a brand new earnings tax slab has been introduced by the Finance Minister of India. As in comparison with the previous tax regime, the brand new tax regime has a decrease tax slab fee nevertheless it eradicates many of the deductions accessible within the previous tax regime. At the moment, one can select between the brand new tax regime and the previous tax regime to file for Earnings Tax in response to their comfort.

Varied Deductions Allowed for Salaried Staff:

1. Home Lease Allowance (HRA):

Bills incurred by workers on staying in rented lodging might be claimed for deduction below the previous tax regime. Nevertheless, the entire quantity of HRA cannot be claimed for deduction. The quantity for which deduction might be claimed is the least of the next:

- Whole HRA paid/acquired by an worker.

- Precise hire paid much less 10% of primary wage

- 50% of the wage for metro cities and 40% of the wage for non-metro cities

Any quantity exceeding the restrict can be taxable on the prescribed fee.

2. Depart Journey Allowance (LTA):

Depart Journey Allowance offered by the employer to journey for skilled work can be taxable below the Earnings Tax Act. Deduction on the quantity acquired as LTA might be claimed by the workers as much as the quantity of precise expense incurred (payments ought to be produced), solely twice in 4 years. It doesn’t embody any bills on private journey.

Depart Journey Allowance is restricted to:

- It ought to be home journey solely.

- Mode of journey ought to be rail, air or some other public transport.

3. Customary Deduction:

A flat deduction of ₹50,000 to all people incomes a wage is named commonplace deduction. It’s supplied to all people choosing the previous tax regime.

4. Varied Deductions Below Part 80C:

Provisions within the Earnings Tax Act 1961 additionally present for varied deductions below specified sections. Deductions might be claimed towards Investments, Allowances, and so forth., which may scale back the taxable quantity of a person. Right here is the checklist of varied sections talked about below the Earnings Tax Act 1961:

1. Part 80C: A most deduction of ₹1,50,000 (together with 80CCC and 80 CCD) might be claimed below this part. Sure investments, saving schemes and a few expenditures are allowed below this part. A few of them are:

- Quantity paid in direction of premium of life insurance coverage

- Quantity paid in direction of premium or subscription for deferred annuity for self or fast household

- A contribution made to Worker’s Provident Fund Scheme

- A contribution made to Public Provident Fund

- A contribution made to any recognised provident fund

- Investments achieved in Put up Workplace Financial savings Financial institution (deposits) for 10 years or 15 years

- Investments made to any recognised securities or deposits scheme (Eg. Nationwide Financial savings Scheme)

- Investments made to any notified financial savings certificates, Unit Linked Financial savings Certificates (E.g. NSC VIII)

- Investments made to ULIPs (Unit Linked Insurance coverage Plans) of any Mutual Fund

- A contribution made to the fund arrange by the Nationwide Housing Scheme

- Funds towards the principal of any housing mortgage

- Funds in direction of the schooling charges of any two youngsters’s full-time schooling in institutes primarily based in India

2. Part 80CCC: Deductions below this part are primarily:

- Cost of premium to any insurance coverage firm in direction of annuity plans.

- Cost of premium for annuity plan of LIC or some other insurer (most cap of ₹1,00,000)

Premium paid in these plans have to be saved deposited with a purpose to avail a deduction.

3. Part 80CCD: Any contribution made in a pension scheme notified by the central authorities by the assessee or the worker comes below this part. The restrict below this part is:

- Within the case of an worker, 10% of the wage within the earlier yr.

- 10% of gross complete earnings in some other case.

4. Part 80D: On this part of the Earnings Tax Act 1961, deductions might be claimed for a most quantity of ₹40,000 on medical insurance coverage. It additional states:

- Deduction allowed for self, partner and dependent youngsters: ₹15,000 (₹20,000 for senior residents)

- Deduction allowed for fogeys (particular person or each): ₹ 5000 (₹20,000 for senior residents)

- Deduction allowed for preventive well being check-ups (throughout the ₹40,000 restrict) : ₹ 5000

5. Part 80DDB: On this part, deductions might be claimed on the quantity not exceeding ₹40,000 spent on medical bills that come up for remedy of a illness or ailment talked about in Rule 11DD of the Act.

6. Part 80E: Below this part, a declare might be made on the quantity paid as curiosity on loans taken for the reason for increased schooling for self or a relative.

7. Part 80EE: Below this part, first-time owners can declare a deduction on their taxable earnings. People having their first residence bought of worth no more than ₹40 Lakh and the mortgage taken for which is ₹25 Lakh or much less are eligible to assert a deduction below this part.

8. Part 80RRB: Below this part, tax might be saved as much as an quantity of ₹3,00,000 on receiving any earnings by the use of royalties or patents registered below the Patents Act, 1970

9. Part 80TTA: Below this part, any earnings earned by an curiosity in a financial savings checking account, publish workplace, or cooperative society as much as ₹10,000 might be claimed for deduction.

10. Part 80U: This part particularly gives a flat deduction on earnings tax solely utilized to disabled folks. As much as ₹1,00,000 might be claimed for deduction relying on the severity of the incapacity.

The best way to Calculate Earnings Tax on Wage?

Sahil, a 28-year-old boy, is working with GFG Pvt. Ltd. incomes ₹25,00,000 each year. He made investments in varied choices accessible below part 80C of ₹1,50,000. He additionally claimed ₹40,000 as LTA and paid hire of ₹3,00,000 within the yr in a non-metro metropolis. The wage breakup of Sahil is:

Let’s decide the payable tax quantity of Sahil in each the previous and new regimes.

Answer:

At first, we’ve to calculate the Internet Taxable earnings of Sahil in each the previous and new tax regimes:

*The HRA deduction is the least of:

- Whole HRA acquired = ₹6,00,000

- Precise hire paid lower than 10% of primary wage, i.e., ₹3,00,000 – (10% of ₹15,00,000) = ₹1,50,000

- 40% of the fundamental wage for non-metro cities, i.e., 40% of 15,00,000 = ₹6,00,000

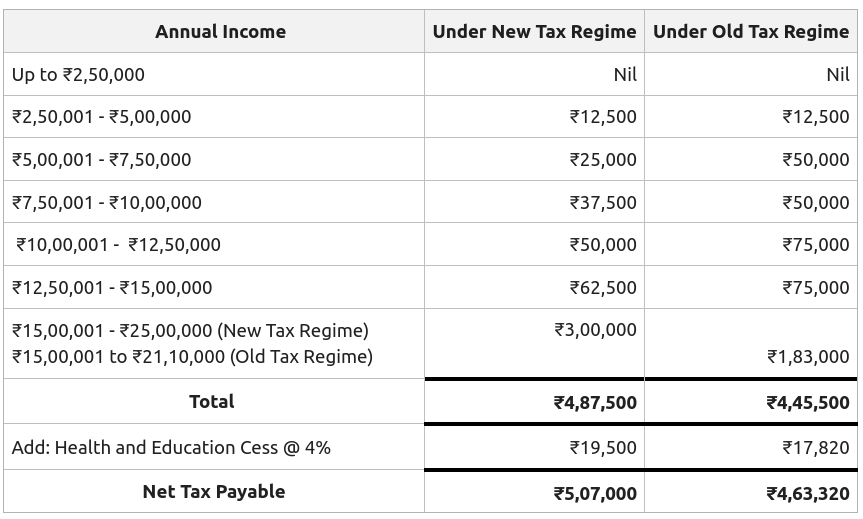

Tax Payable as per the Earnings Tax Slabs:

So, the online tax payable below the brand new tax regime is ₹5,07,000, and within the previous tax regime ₹4,63,320, which is ₹43,680 increased.