It was once {that a} chief monetary officer’s main focus was on the standard capabilities of the job: monitoring money stream and monetary actions; serving as a controller and accounting knowledgeable; limiting pointless spending; and making certain that monetary selections conformed to straightforward working procedures.

These duties are nonetheless crucial, after all, however they’re more and more turning into secondary to the strategic roles CFOs are being requested to play. Because the tempo of enterprise accelerates and expertise advances, the fashionable CFO should take a broader, extra forward-thinking and growth-oriented strategy to the job.

The consulting agency Accenture captured this transformation in a 2022 survey, discovering that typical finance chiefs now spend most of their time spearheading companywide efforts to remodel and optimize enterprise operations, with an emphasis on accelerating income and revenue development.

It’s a brand new actuality that I’ve seen play out amongst fast-growing small and medium-size healthcare corporations the place I’ve held various management positions. These firms not solely anticipate you to be a useful CFO, delivering on primary accounting duties, in addition they anticipate you to be a strategic CFO, working with the management group to discover development alternatives and maximize profitability.

So how do you develop this strategic experience? Via trial and error, I’ve realized that the best manner is to focus in your present finance capabilities and duties—these capabilities which are already inside your purview as a CFO—and elevate them to ship the strategic perception your organization wants.

On this article, I share six areas the place I like to recommend you focus. The event of the talents I talk about could be utilized broadly to development firms and employed throughout a large spectrum—by fractional CFOs working with later-stage startups, by interim CFOs in distressed conditions, and even by finance chiefs employed by public firms.

With regards to increasing and bolstering your present capabilities, I talk about the simplest areas first. The later ones, particularly company imaginative and prescient, will most likely devour extra of your time, however I anticipate you’ll discover that mastering them is effectively value it to you and your organization. I embrace examples to indicate you the way I put every of those ideas into motion.

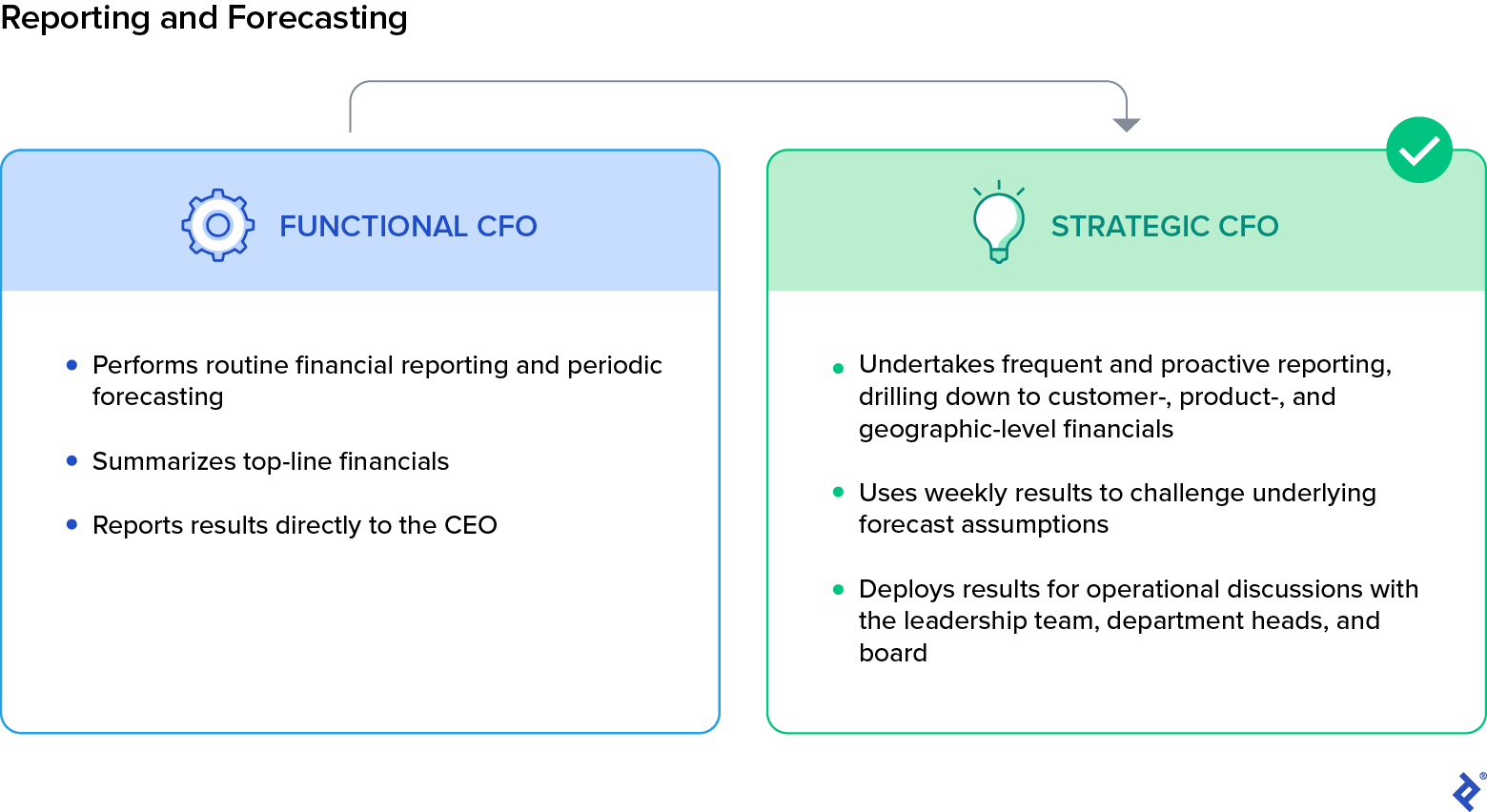

1. Reporting and Forecasting

Reporting and forecasting are desk stakes for a finance chief. The proliferation of software program as a service (SaaS) and cloud providers has made it simpler and cheaper to combine highly effective accounting techniques throughout a company. A useful CFO should make sure that everybody who wants entry to those techniques has been totally onboarded and is utilizing them, whereas a strategic chief seems for alternatives to delve deeper into the data to floor actionable insights for the group.

I can greatest clarify tips on how to develop this space by sharing how I demonstrated to 1 firm that totally onboarding a group is a necessary step—even for management. I labored for an early-stage healthcare providers firm the place the CEO tracked company financials on an Excel worksheet he saved on his desktop and up to date at night time and on weekends. This apply created apparent issues. First, his shadow financials had been usually incomplete. Second, his apply precipitated a disconnect that prevented the finance group from creating a routine of updating data and producing helpful and well timed insights for the CEO. With out this routine, the CEO was flying blind when it got here to gross sales and profitability decision-making.

After I joined, I helped the corporate standardize all of the accounting, operational, and monetary reporting templates, and the chart of accounts. The corporate and I then agreed on a reporting calendar for when the finance group would give the CEO and board the newest revenue assertion, steadiness sheet, money stream assertion, and customer- and product-level segmentation. That report additionally often supplied data on the efficiency of particular person departments, evaluating the figures for every with that division’s price range, forecast, and prior-year numbers.

We didn’t cease with standardizing companywide reporting, nevertheless. We leveraged the data to advocate operational modifications that may enhance areas of monetary underperformance. This not solely freed up the CEO’s nights and weekends, but additionally gave us strategic perception into the corporate’s operations whereas decreasing the administration group’s nervousness and stress underneath the earlier fragmented reporting system.

2. Monetary Planning and Evaluation

The subsequent logical step for a strategic CFO is to search for methods to use standardized databases and quantitative expertise in monetary planning and evaluation. FP&A is often used to provide data-driven solutions to monetary and operational efficiency questions dealing with any side of the corporate. Some are routine analyses, comparable to evaluating the present interval’s efficiency to the prior one’s, whereas others are advert hoc analyses comparable to calculating the return on funding for a brand new gross sales enablement expertise platform. A strategic CFO makes use of the identical processes and will deal with a number of the similar questions as a useful CFO however takes a extra proactive strategy.

After I joined a pharmaceutical producer as CFO, I discovered that few of the corporate’s senior leaders knew which buyer, product, or geography generated the best development or income. This turned an issue when the corporate needed to rapidly enhance profitability. After implementing primary reporting enhancements, I carried out a complete profitability evaluation of the corporate’s a number of enterprise and buyer segments to start to reply broader strategic questions.

Utilizing FP&A enterprise intelligence instruments like Microsoft Energy BI, we pinpointed the sources of the best development and the best earnings and losses. We then broke them down by product class, product SKU, buyer, enterprise unit, and geography. However we didn’t simply produce a report that sat in colleagues’ inboxes. We looped in cross-functional groups to assist us design, develop, and glean insights from the stories, and hosted in-depth conversations with govt leaders of every useful space about industrial and operational modifications that may maximize monetary efficiency.

Inside a short while, the corporate had a holistic understanding of which segments contributed earnings. Simply as vital, we had full alignment amongst senior leaders that we should always deal with probably the most worthwhile segments. This technique allowed us to just about double the corporate’s profitability in lower than a 12 months.

3. Threat Administration and Mitigation

If finance leaders thought threat administration was simply an administrative footnote to monetary oversight, then the COVID-19 pandemic and breakdowns in world provide chains upended that false impression. As we speak, CFOs should take a job in pushing groups throughout the group to make threat assessments and often deal with questions of mitigation. On the similar time, they should see threat administration by means of the prism of alternative, searching for the place it creates potential industrial openings.

For instance, from 2017 to 2020, I used to be chargeable for a bunch of firms that imported crucial elements for medical merchandise to China or assembled them there. The businesses loved cross-border, lower-cost arbitrage and persistently expanded gross margins for a few years. Nonetheless, once I joined, I might see operational, regulatory, and macroeconomic dangers on the horizon. We engaged senior leaders in thought-provoking quarterly discussions to anticipate doable hazards so we might dedicate assets and take motion to mitigate probably the most urgent materials dangers. The groups persistently highlighted the doable operational and monetary dangers of cross-border commerce limitations disrupting crucial part shipments.

This proved prescient when a commerce battle flared up between the US and China in 2018. As a result of we had been ready by means of our threat planning, my group of firms was in a position to decrease provide chain disruptions by leveraging backup part sources in different elements of Asia and Europe. Integrating threat administration into the corporate tradition allow us to not solely cut back or neutralize dangers, but additionally restricted influence on the underside line, creating industrial alternatives for our gross sales and advertising and marketing groups to extend market share. We continued reliably delivering merchandise and options whereas our opponents had been nonetheless dealing with disruptions.

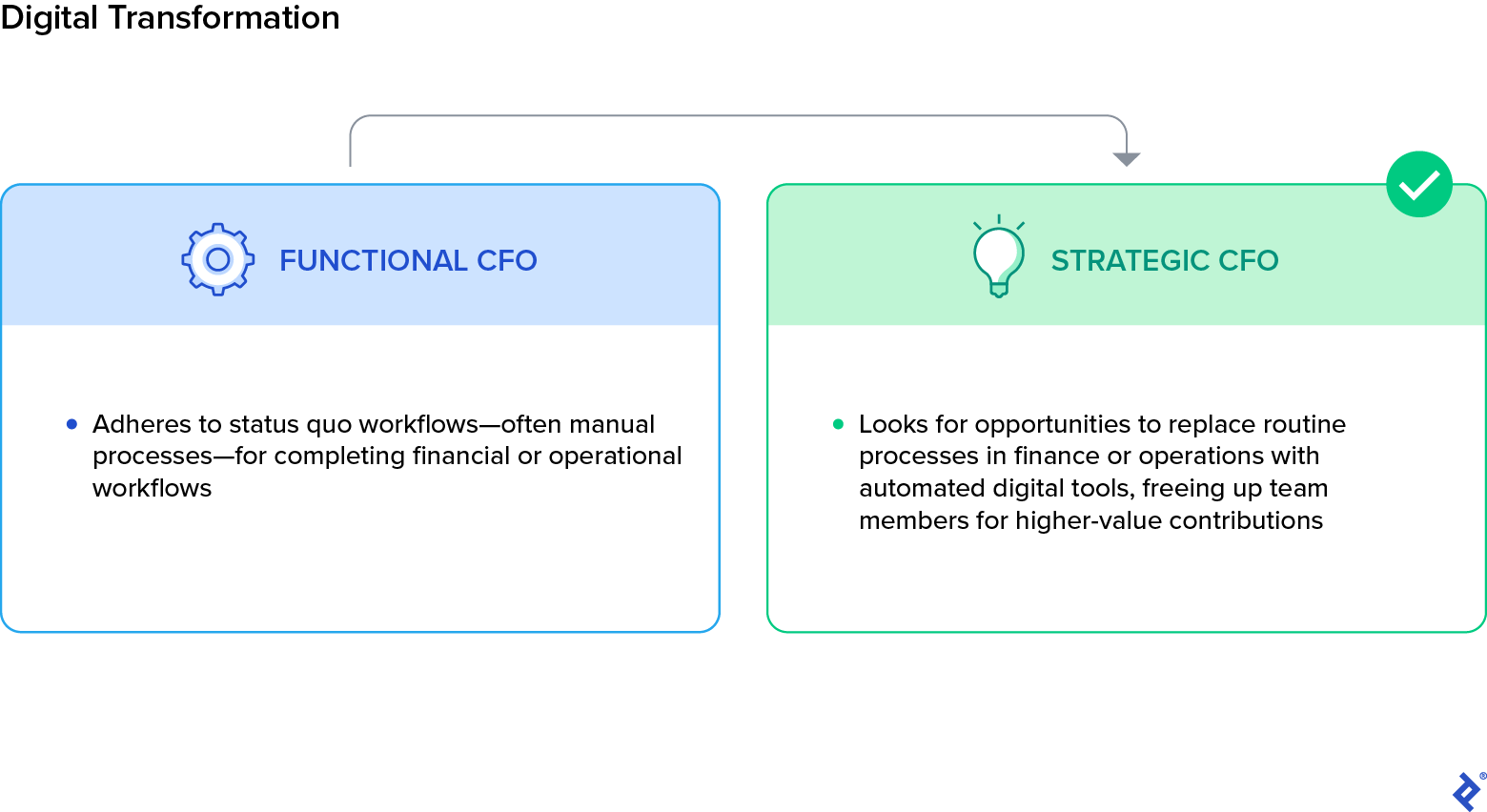

4. Digital Transformation

It’s routine for a CFO to ask division heads to do extra with much less. Finance chiefs can prepared the ground by doing so themselves, inspecting methods to automate back-office operations to free workers from repetitive duties whereas saving money and time. Automation may support the finance division because it offers with the fixed cycle of labor spiking inside tight timetables: month-to-month closes, pressing evaluation requests, and the crunch interval round mergers and acquisitions. Being perpetually wanting arms and hours inevitably results in excessive ranges of stress.

I realized how vital this transition was firsthand. After a reorganization at a world manufacturing agency, my finance group was staffed with simply two enterprise analysts. This lean group was chargeable for reporting and analyzing monetary outcomes for 25 portfolio firms each month inside two enterprise days. It merely wasn’t possible for 2 folks to finish this spreadsheet-based copy-and-paste undertaking inside 48 hours. Automation was the one answer.

We invested a small quantity into robotic course of automation to deal with routine reporting processes and restructured the group’s strategy, serving to the 2 analysts change into consultants in enterprise intelligence and visualization programming. Utilizing these applied sciences, the 2 had been in a position to full the reporting duties in a single working day. They used the time they saved to undertake evaluation and work with enterprise leaders to enrich the reporting with actionable insights.

Seizing on these learnings, our company growth groups took an identical strategy: They automated their month-to-month outreach, permitting them to contact 10 occasions the variety of potential acquisition targets and thus domesticate a bigger associate pipeline.

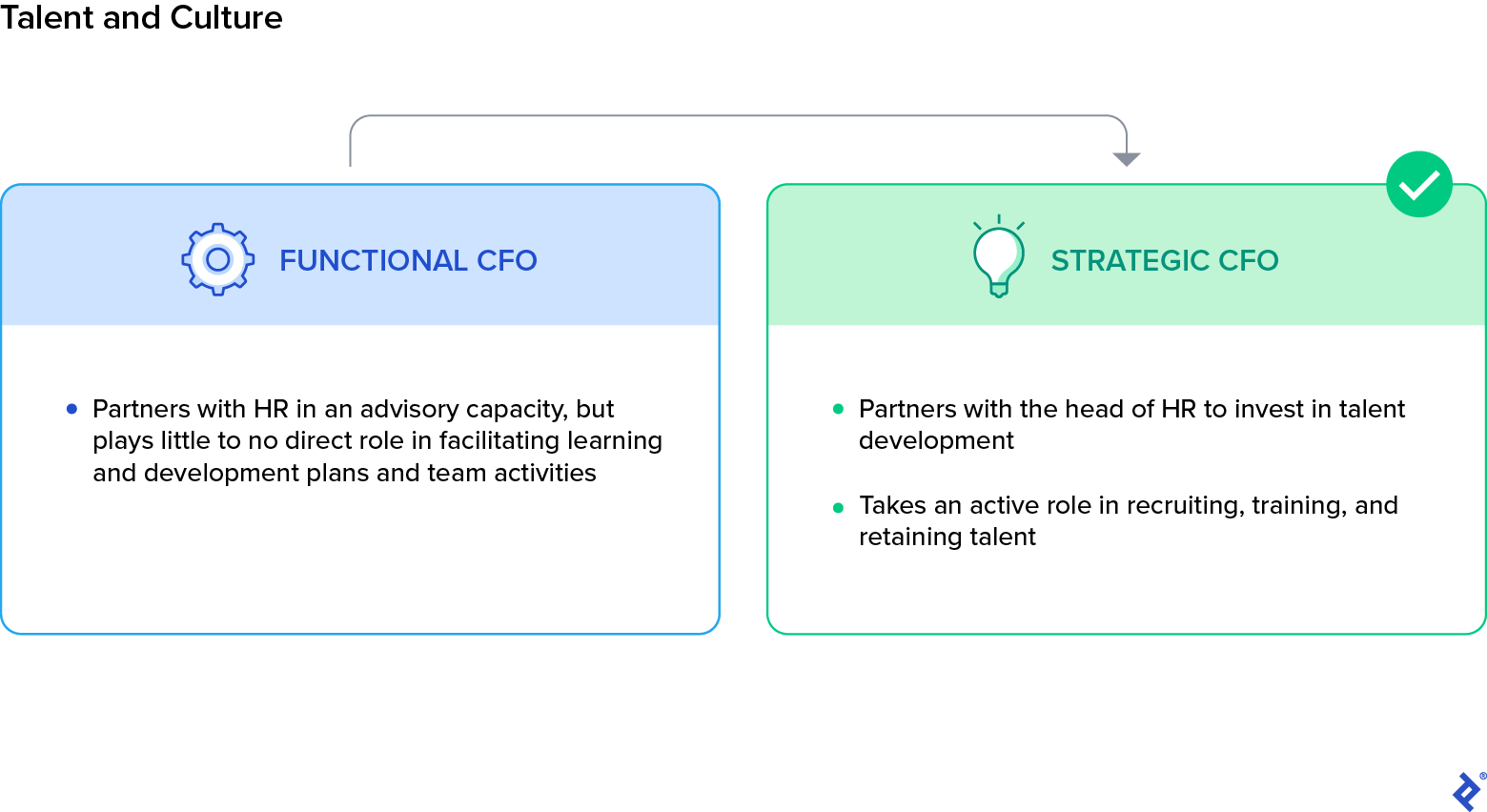

5. Expertise and Tradition

One precious manner a CFO can take a extra strategic function is by turning into extra straight concerned in recruiting and cultivating expertise. As an alternative of simply advising HR on staffing necessities, a strategic CFO will associate with HR to create alternatives to carry high-performing monetary expertise into the group.

For example, I as soon as helped recruit a really proficient govt to a small healthcare system manufacturing firm that my agency owned, though I knew we had been going to promote it inside the subsequent 12 months. We requested this individual to affix because the vice chairman of finance, stabilize the corporate, and efficiently full the sale—though we didn’t have a selected function lined up for him afterward. This may have been a tough promote had we not approached this candidate with transparency, honesty, and a dedication to retaining him in a senior function.

A 12 months after the sale, we delivered on the dedication and he turned CFO of our largest portfolio enterprise. Three years later, he was promoted to be the holding firm finance chief, overseeing all portfolio firms.

As CFO, taking an energetic function in creating a high-potential finance chief meant I used to be contributing to the corporate’s long-term technique by serving to to safe an worker who might steer the corporate in a post-sale future. Whereas all of this transpired within the finance division, others in several useful areas seen and adopted related approaches to recruiting and cultivating high-potential expertise in gross sales, advertising and marketing, operations, and expertise.

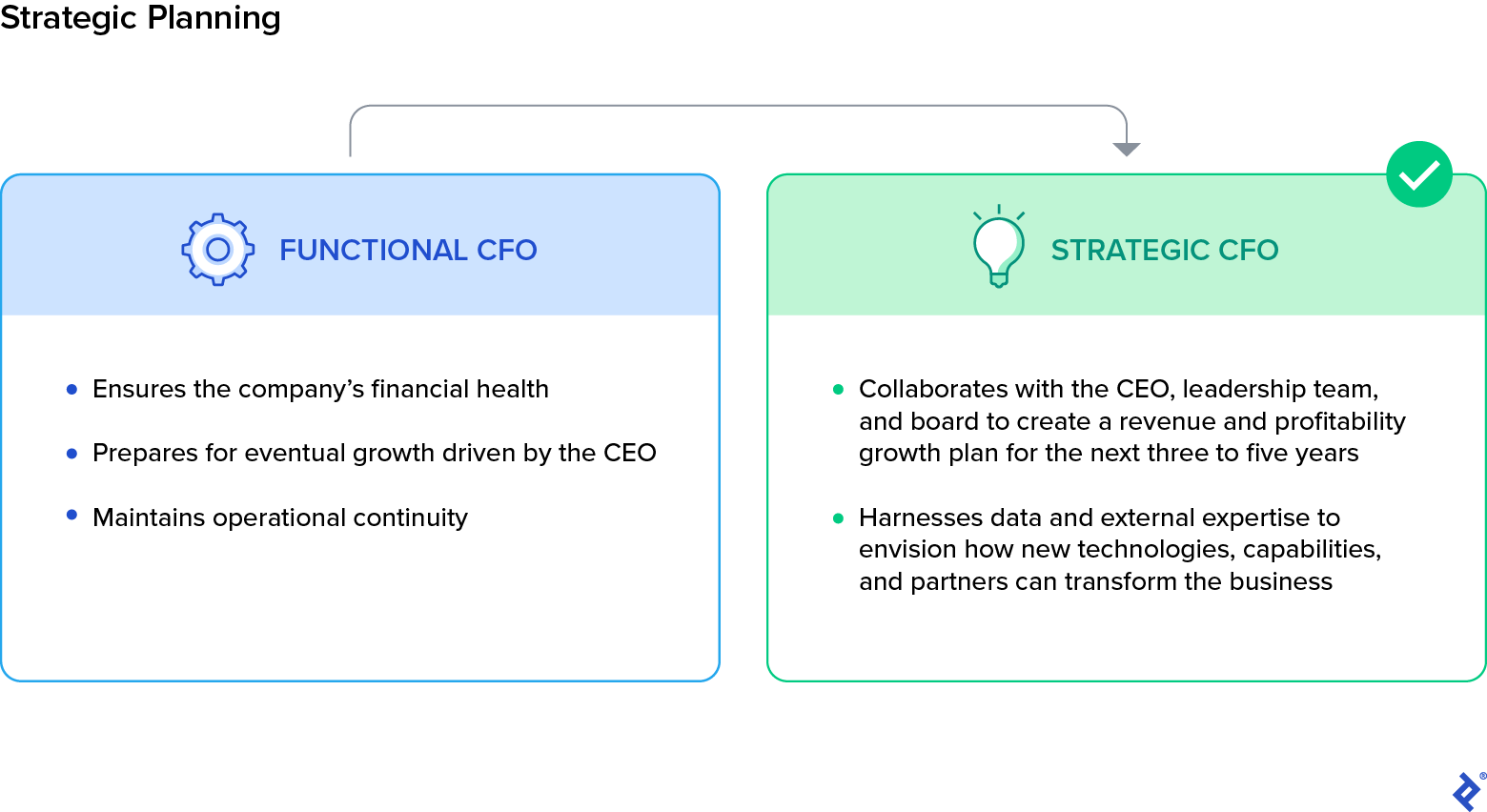

6. Strategic Planning

Corporations worth the exhausting information and empirical mindset {that a} finance chief lends to strategic planning. The CFO can use this as a possibility to contribute to the transformation of an organization’s industrial objectives or capabilities, as an example, by championing acquisitions or introducing partnerships to increase aggressive benefits.

I had the chance to place this into motion whereas working with an rising markets cardiovascular diagnostic firm that made coronary heart screens. The corporate had aggregated terabytes of coronary heart rhythm information by means of the 1000’s of units it had offered. This information was a novel asset, however the firm didn’t use the data for any industrial functions. As CFO, I thought of any massive supply of distinctive information as a potential alternative in a world the place SaaS enterprise fashions could be commercialized rapidly.

I challenged the group to make use of that information as the idea of an analytics service whereas defending affected person confidentiality. After months of growth with native software program companions, the group unveiled a brand new service to hospitals to offer real-time monitoring, evaluation, and alerts if the software program detected irregular rhythms in a affected person. The service deepened buyer relationships and added a extremely worthwhile income stream.

With better visibility and deeper insights concerning the firm, the strategic CFO develops a perspective about what merchandise, capabilities, and M&A alternatives can create transformative worth for his or her firm. But it’s vital to needless to say what actually elevates your contribution to a development firm comes right down to management.

The demand on corporations to satisfy targets is immense, particularly as macroeconomic pressures rise and enterprise capital, non-public fairness, and public market expectations for monetary efficiency proceed to climb. Corporations want management, and leaders should ship development. The strategic CFO is uniquely empowered on this respect. When the fashionable CFO rises above their useful duties and offers precious strategic insights, they might help their firm rework and develop for the longer term.