Companions of 3one4 Capital, a enterprise capital agency in India, just lately went on a highway present to lift a brand new fund. Inside two and a half months, on the top of the worsening international economic system, they’d secured $200 million. It’s the fourth marquee fund for the Bengaluru-headquartered fund, whose portfolio consists of 4 unicorn startups.

The fund, sixth general for 3one4 Capital, was oversubscribed to $250 million however the agency is accepting solely $200 million to maintain itself lean and disciplined, mentioned Pranav Pai, co-founder and accomplice at 3one4 Capital. The agency’s resolution to restrict the fund measurement is emblematic of its strategic selections, which have set it aside from different Indian enterprise corporations.

“We’re recognized to offer good returns. Our efficiency has been benchmarked among the many greatest main performing funds within the house. So we requested ourselves the onerous questions, can we proceed our efficiency with a bigger fund measurement? Will we even want that a lot capital for the early-stage?” mentioned Pai in an interview with TechCrunch.

Lately, a surge of enterprise capital corporations in India have raised unprecedentedly massive funds, sparking considerations in regards to the accountable allocation of this capital, significantly for early-stage startups. Critics query whether or not there are sufficient viable firms within the Indian market to soak up and successfully make the most of such vital investments.

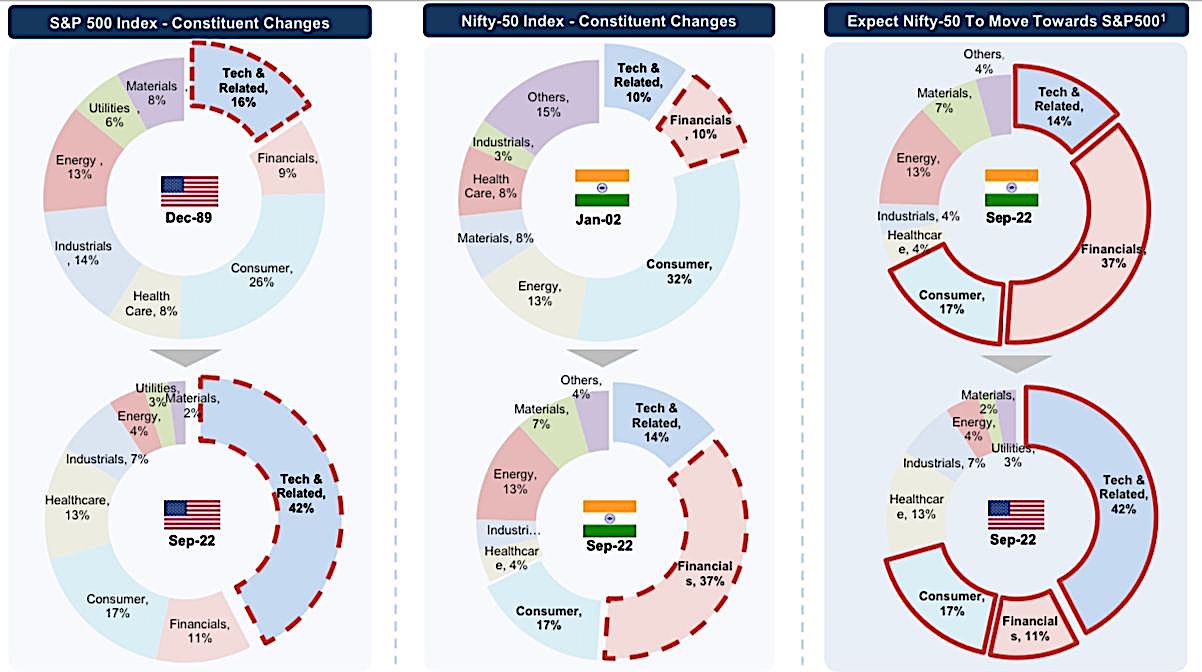

Pai, pictured above, asserts that there’s ample room for extra Indian firms to pursue IPOs, because the nation’s IPO market has confirmed profitable and well-regulated for institutional buyers. He anticipates a metamorphosis in India’s inventory index, with an growing variety of tech firms, apps, providers, fintech, and fee options changing into a part of the index.

A take a look at how S&P 500 Index and Nifty 50 Index have advanced over the many years and projections for future. (Picture and evaluation by Mirae Asset)

Regardless of this, Pai acknowledges that the Indian market has but to completely notice its potential for mergers and acquisitions. Though there was progress in M&A exercise—growing three to 4 instances previously 5 years—it stays beneath expectations. For the Indian market to flourish, Pai emphasizes the necessity for a extra strong M&A panorama.

Over the past half-decade, quite a few Indian enterprise corporations have shifted their consideration to early-stage investments. Regardless of this elevated focus, the market continues to depend upon worldwide buyers to help mid- and growth-stage offers, highlighting the necessity for additional progress in India’s enterprise capital ecosystem. “We now have excessive performing mutual funds and PEs. We hope that extra of those corporations will launch devoted funds for Indian startups,” he mentioned.

Half of the capital within the new fund for 3one4 has come from Indian buyers, one other side that differentiates the agency from a lot of its friends. All of the systemically necessary Indian banks, and the highest 5 native banks by market cap general have invested within the new fund. Eight of the highest 10 mutual fund operators are additionally LPs within the new fund, mentioned Pai. “We’re additionally proud to have main international endowments, sovereigns and insurance coverage firms as LPs,” he mentioned.

“We need to be India’s main homegrown enterprise capital agency. We’re based mostly right here, we make investments right here – we don’t need to spend money on Southeast Asia – and our fund measurement and technique are aligned with alternatives in India. As our firms have IPO-ed through the years, now we have seen the significance of getting India’s largest establishments working with us to assist construct these firms. It will be troublesome if we didn’t have banks to assist our firms from all the pieces from income assortment to payrolls. And mutual funds are patrons, guide runners and market makers for IPOs and them shopping for the inventory provides a vote of confidence to the market,” he mentioned.

3one4, which focuses largely on early-stage and in sectors together with direct-to-consumer tech, media and content material, fintech, deep expertise and SaaS and enterprise automation, right now manages about $750 million in AUM and its portfolio consists of HR platform Darwinbox, business-to-business targeted neobank Open, consumer-focused neobank Jupiter, Licious, a direct-to-consumer model that sells meat, native social networks Koo and Lokal, leisure service Kuku FM, fintech Increase Monetary, and gaming agency Loco.

3one4 Capital has gained a fame for its contrarian funding method, as exemplified by its early funding in Licious. Over 5 years in the past, the prevailing opinion held that India’s price-sensitive market wouldn’t pay a premium for on-line meat supply. Nonetheless, Licious has since grown into one in all South Asia’s largest direct-to-consumer manufacturers, with a presence in roughly two dozen cities throughout India.

One other instance of 3one4’s daring investments is Darwinbox, a guess made at a time when most buyers doubted the power of Indian SaaS firms to broaden internationally or garner adequate native enterprise subscriptions.

3one4 Capital’s contrarian method extends to the investments it has intentionally prevented as effectively. In 2021, amidst a frenzy of funding exercise within the crypto house, almost each fund in India sought alternatives and backed crypto startups. Nonetheless, 3one4 Capital, after thorough analysis of the sector, selected to not make any investments in crypto.

The agency, which employs 28 folks, can be specializing in setting new requirements in transparency and governance for itself. It’s the primary VC to be a signatory to UN PRI, it mentioned. “We now have to report, behave, act and look a sure method. We now have to appear to be the fiduciary of greatest establishments on this planet, after which and solely then we high quality to inform our portfolio founders that that is how we need to create greatest at school firms with you,” mentioned Pai.